I am directing a local Classical Conversations group, and many churches in our area will not consider housing us because we are not a nonprofit. Since I am basically an independent contractor licensed by CC corporate to run a community in my area, am I potentially eligible to have my community declared a nonprofit?

-Jen, Classical Conversations Director

Jen,

I recently discussed nonprofit status for CC Communities with Classical Conversations COO, Keith Denton. He explained to me that “CC Directors (who are licensees of CC) may form an entity through which to run their homeschooling operations.

“CC does not require a director to run his/her homeschooling program through an entity, nor does it require that such director choose a specific type of entity (non-profit versus for profit) for its homeschooling community.

Keith Denton, Classical Conversations COO

CC recommends that all directors consult with an accountant and lawyer when making the decision of whether to form an entity, and what type. The decision of which entity to form depends on a variety of factors specific to the director and state where the homeschooling community is formed. As such, consultation with an attorney and accountant in a director’s community is highly recommended to best address all relevant factors. “

HomeschoolCPA has helped several classical homeschool programs apply for 501c3 tax exempt status, but not a CC community under a CC licensed director. In other words, most homeschool groups leave Classical Conversations when then form as a nonprofit organization. They enjoy the freedom to chose their own curricula and the freedom from paying CC’s licensing fees.

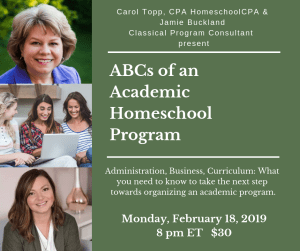

Have you considered wanting to start a homeschool program? An academic program, but not a co-op and not a for-profit business, either. But a nonprofit organization with an academic emphasis–maybe with a classical education focus.

Sounds like a great idea! But where to begin? Carol Topp, CPA, the Homeschool CPA and Jamie Buckland are teaming up to to bring you:

ABC’s of an Academic Homeschool Program

An hour-long webinar that covers the Administration, Business and curriculum aspects of running an academic homeschool program.

Carol Topp, CPA

HomeschoolCPA.com

I direct a Classical Convwrsations group in Ponca City, OK and have for the last 3 1/2 years at our current location, First Baptist Church, Ponca City. This week the church asked an auditor to come in, and she said we needed to be a nonprofit to operate there. What do I now?

A in Ponca

Aimee,

I guess you have a few options:

1. Find another church that will allow your CC group to meet there.

2. Ask the church and the auditor WHY your CC group needs to be a nonprofit. (IOW, push back). You may not like their answer, but at least you might request time to evaluate your options and pursue #1 or #3

3. Reorganize your CC group as a nonprofit organization. This involves forming a board, creating bylaws, applying for 501c3 tax exempt status with the IRS, etc. You may ask the church to grant you some time (3-6 months) to get re-established as a nonprofit organization.

I can help if you pursue #3. Start by reading my Articles and blog posts and my book, The IRS and Your Homeschool Organization.

Carol Topp, CPA

hi i am a new director to cc , i need to complete my 1099 and it is asking for and EIN#, i have not formed and Entity so do i just leave the field blank?

No. Do not leave it blank. Use your Social Security Number instead.

If you are giving 1099-MISC forms to your tutors, you are late. They were due to the IRS and your tutors on January 31. The IRS may assess late fees for submitting the 1099-MISC late.