I take seriously my responsibility as a CPA to help my clients not just file their annual IRS returns, but to help you better manage your organization and comply with your fiduciary duties of care and compliance.

In order to help you come into better compliance, I have some resources to help you:

1. A webinar Financial Reports for Homeschool Nonprofits that you can view here.

Also included is a handout.

2. Guidelines I call Standard Nonprofit Accounting Format detailed below.

View these guidelines in a Word document: Standard accounting format

Standard Nonprofit Accounting Format

Statement of Activity (also known as Income and Expenses or Profit and Loss)

- Income (also called Revenues) should be listed by category at the top of the Statement of Activity

- Categories of Income should be the four standard nonprofit accounting categories:

- Donations

- Program Income

- Fundraising Income

- Income

Subcategories under these 4 standard categories can be unique to your organization.

- Expenses will be categorized into four standard nonprofit accounting categories and listed below the Income categories:

- Program Expense

- General and Administration Expenses

- Fundraising Expense

- Misc Expenses

Subcategories under these 4 standard categories can be unique to your organization.

Some expenses such as Wages and Payroll, should be separated into Program or General & Administrative subcategories depending on what the worker was paid to do.

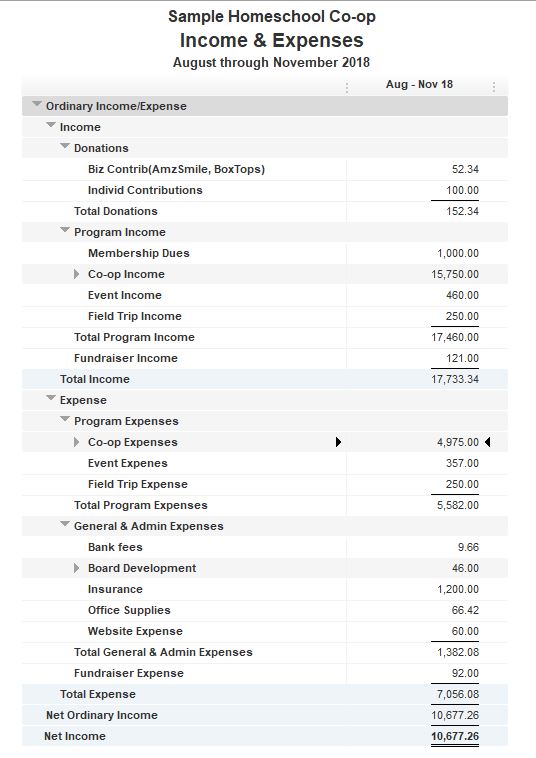

Your Statement of Activity/Income and Expenses should look something like this:

Notice the 4 categories of Income (combine Interest Income and Other Income into Misc. Income) and the 4 categories of Expense (Combine Other Types of Expenses and Ask My Accountant into Misc. Expenses).

The indents and subcategories make the statement easy to read.

Some treasurers will add subtotals, but this report left them off.

The bottom line of Net Income is easy to see.

Refund or discounts for Co-op fees are displayed as a reduction in income and are the only negative number allowed on the statement.

Statement of Financial Position (i.e. Balance Sheet)

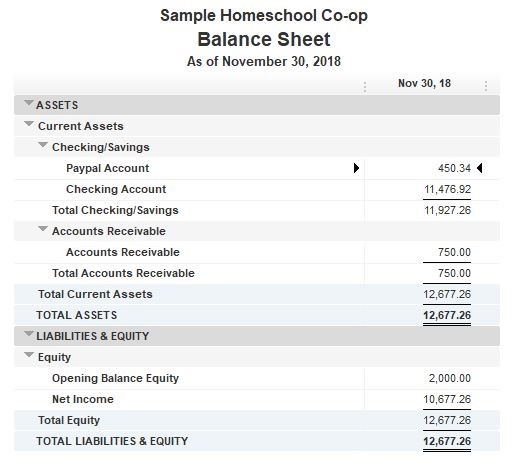

- Assets listed at the top. Assets should include all checking, savings, and PayPal/Stripe accounts

- Liabilities listed below Assets

- There should be no negative amounts

- Net Income on the Statement of Activity should match Net Income on the Statement of Financial Position. If not, there are serious errors in your record keeping. You will need to hire a qualified bookkeeper and/or QuickBooks expert to make corrections.

Your Statement of Financial Position (i.e. Balance Sheet) should look something like this:

If your financial reports do not comply with these standard nonprofit accounting reports, you may need additional bookkeeping assistance.