Are my homeschool co-op fees tax deductible?

Are homeschool co-op fees tax deductible?

Are homeschool co-op fees tax deductible?

Should a homeschool group serve as a charity? Maybe, but maybe not.

Donors who give to your nonprofit expect that 100 percent of their gift will be used to support your mission.

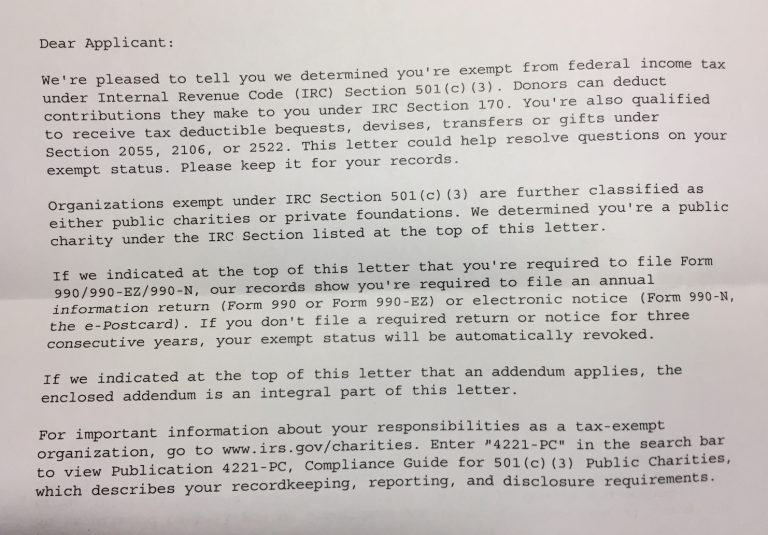

The IRS tells a small homeschool group that they cannot accept tax-deductible donations.

Give your parents a simpler invoice from your homeschool program (please!).

Can a landlord can claim a deduction for the reduced rent she gives to a homeschool group?

Gifts to an individual family are NOT tax deductible donations to the donor.

Carol, My homeschool group (a 501c3 nonprofit) was donated $500 in science equipment. How to I record a gift like this in my record keeping? We use QuickBooks. How wonderful to receive such a generous donation. As a 501(c)(3)…

Did you know that having a donation button on your website could mean that your organization would need to register as a charity in almost all 50 states?

What are the tax liabilities of a homeschool group giving scholarships?