Are Classical Conversations tutors employees or independent contractors?

The question of whether CC tutors are independent contractors or employees is not cut and dried but HomeschoolCPA can help.

The question of whether CC tutors are independent contractors or employees is not cut and dried but HomeschoolCPA can help.

Hello Carol! I graduated from college in May and am currently working on my masters degree in Elementary Education. A friend put me in contact with one of her family friends for a job opportunity as a homeschool teacher while…

There's a new tax deduction for business owners in 2018!

The IRS determinations on worker status is based on common law, not scientific facts.

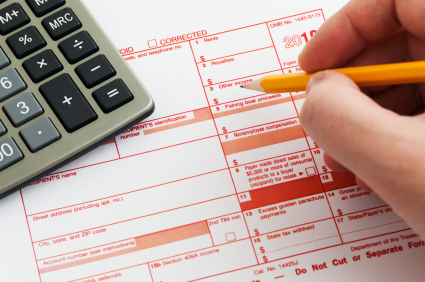

A Classical Conversations Director can give discounts on tuition to an Independent Contractors or employees but there is an important catch!

What is the difference with between Classical Conversations tutors and online tutors in the eyes of the IRS?

Nonprofit organizations still have to pay payroll taxes

A tutored hired to teach a homeschooled student wonders if she is am employee of the family who hired her.

Help with taxes for Classical Conversations Directors.

I learned of a former Classical Conversations (CC) Director that left CC and started a nonprofit homeschool group in spring 2021. She forgot to file Form 1099-NEC for her 6 CC tutors that she paid in early 2021. The Form…