Homeschool group not open to the public. Is that allowed?

501c3 groups serve a public good but can they limit membership to their group?

501c3 groups serve a public good but can they limit membership to their group?

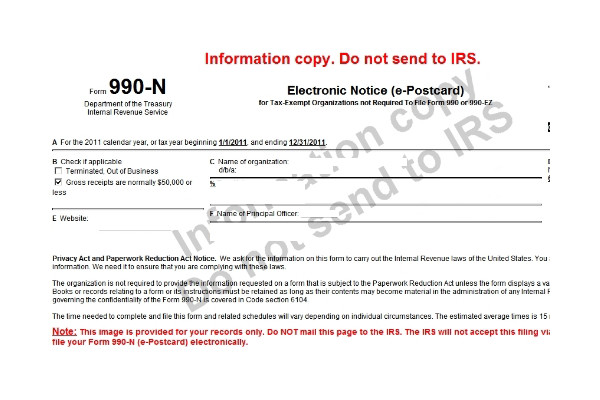

There is a new website for filing the IRS ePostcard, Form 990-N

Homeschool organizations cannot accept tax deductible donations until they have 501c3 tax exempt status.

What should a homeschool group do when given a donation?

The story of a small homeschool support group that grew into a full-fledged nonprofit organization

Fiscal sponsorship is a great idea and something your homeschool group should consider.

Several homeschool organizations were granted 501(c)(3) tax exempt status by the IRS

A Classical Conversations director wants nonprofit status for her CC Community.

Homeschool leader cannot find her group in the IRS database of exempt organizations.

Homeschool organizations need to have their financial information and organizing documents ready to send into the IRS when asked.