What Homeschool Leaders Don’t Know About IRS Annual Reports

A report that the IRS requires from all tax exempt organizations--including your group! It's called the Form 990.

A report that the IRS requires from all tax exempt organizations--including your group! It's called the Form 990.

I have spoken to several Classical Conversations (CC) Directors lately who tell me that they gave themselves a 1099-MISC to report what they paid themselves.

Are homeschool co-op fees tax deductible as childcare expenses?

Most homeschool groups that use volunteer parents and vary the classes offered each year do not fit this IRS definition of a school.

Does applying for 501c3 status mean government intervention into homeschooling?

IRS lowers fees on Form 1023-EZ

A homeschool group can gather without needing to file reports with the IRS, but they will be limited.

A fundraiser can bring in so much income that it can jeopardize your 501c7 status because the fundraiser income exceeds 35% of total income.

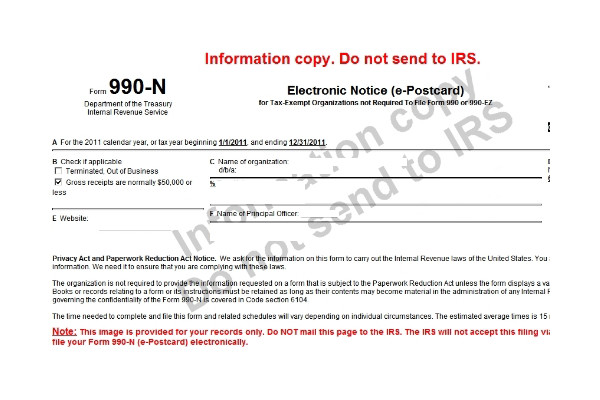

There is a new website for filing the IRS ePostcard, Form 990-N

Hard working volunteers in a homeschool organization, who get a discount on tuition, could have to report and pay taxes on their "compensation."