How can I thank my volunteers?

Ways to thank your volunteers that are tax-free.

Ways to thank your volunteers that are tax-free.

How should early deposits be recorded in a homeschool group's bookkeeping?

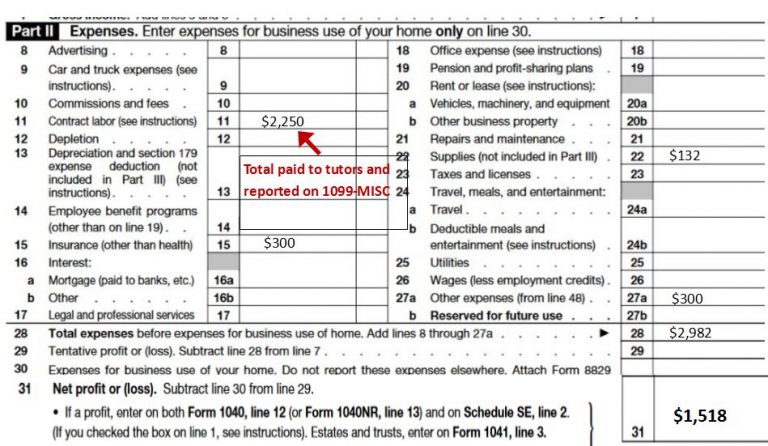

Homeschool business owners can learn how to prepare their tax returns

A new Classical Conversations Director asks how to report her income and expenses on her tax return.

Gifts to an individual family are NOT tax deductible donations to the donor.

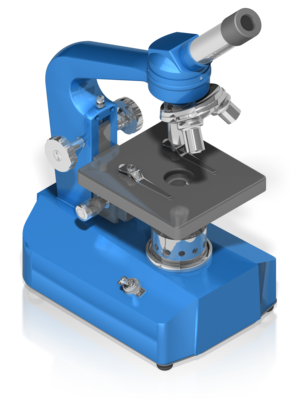

Are educational classes like violin lessons and ballet classes tax deductions?

Are homeschool co-op fees tax deductible as childcare expenses?

April 15 was a little late for a Classical Conversations Director to ask if she needed to file any forms with the IRS!

A homeschool leader asks how to account for accumulated money on a financial statement

Carol, My homeschool group (a 501c3 nonprofit) was donated $500 in science equipment. How to I record a gift like this in my record keeping? We use QuickBooks. How wonderful to receive such a generous donation. As a 501(c)(3)…