IRS amnesty program for employers (how to avoid penalties for paying workers as Independent Contractors)

What can you do to avoid the IRS penalties on misclassifying employees?

What can you do to avoid the IRS penalties on misclassifying employees?

A few creative ways to run a homeschool co-op without hiring employees or dealing with payroll.

A podcast episode that explains the difference and why it matters how you classify your homeschool group's workers.

A podcast episode that explains the difference and why it matters how you classify your homeschool group's workers.

Helping homeschool leaders understand how to classify their workers correctly as employees or independent contractors.

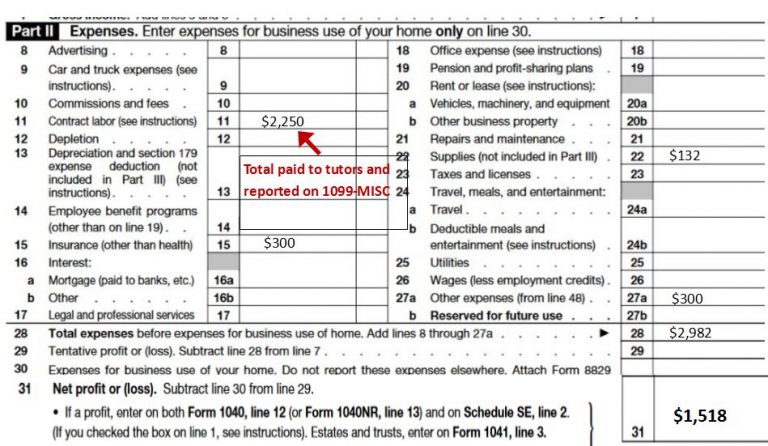

A new Classical Conversations Director asks how to report her income and expenses on her tax return.

Tips for homeschool tutors on their status as an employee or independent contractor.

I have spoken to several Classical Conversations (CC) Directors lately who tell me that they gave themselves a 1099-MISC to report what they paid themselves.

A homeschool co-op teacher asks where she reports her income from teaching.

Are educational classes like violin lessons and ballet classes tax deductions?