Don’t tell the IRS your homeschool group is a private foundation (if it’s not).

A homeschool group incorrectly tells the IRS they are a private foundation.

A homeschool group incorrectly tells the IRS they are a private foundation.

How a homeschool group can "self declare" its tax exempt status.

It’s easier than ever to get tax-exempt status. Should your group apply?

Nonprofit organizations still have to pay payroll taxes

Most homeschool groups that use volunteer parents and vary the classes offered each year do not fit this IRS definition of a school.

Does applying for 501c3 status mean government intervention into homeschooling?

A homeschool leader wonders if her homeschool co-op can be defined as a "school."

Homeschool organizations need to have their financial information and organizing documents ready to send into the IRS when asked.

A homeschool support group knows it needs to file an annual report with the IRS but how?

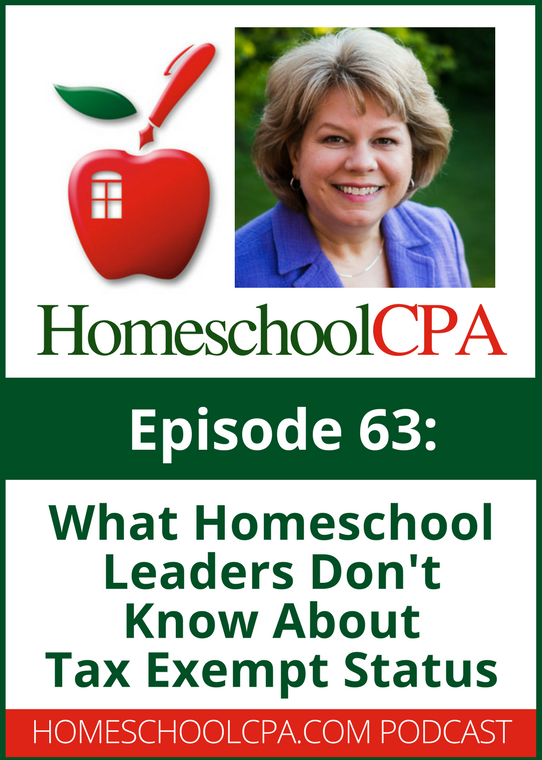

Congratulations to Christian Homeschool Organization Interact Connect Encourage (CHOICE) in South Carolina on recently receiving 501(c)(3) tax exempt status with the IRS.