We don’t want 501c3 status. Should we still include the IRS language in the Articles?

A homeschool group doesn't want tax exempt status.

A homeschool group doesn't want tax exempt status.

Does a nonprofit need to file a tax return before they receive tax exempt status? Yes, the IRS requires organizations to file information returns before they apply for tax exempt status. Here’s what the IRS website states: Tax Law…

Some homeschool groups are very small and are not interested in the benefits of 501 c3 tax exempt status such as accepting donations or doing fundraising. Do these small homeschool groups really need 501c3 tax exempt status? No. They…

The IRS claimed a small charity should have filed the longer Form 1023.

This book is for anyone who mistakenly thinks they don't have to do any annual reports to the IRS.

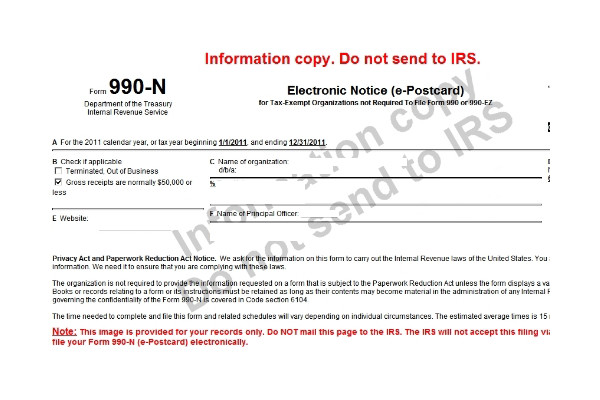

This video shows you what information you need to file the IRS Form 990-N

Adding a football program to your homeschool group does not mean it is a separate legal identity. It can be one of the programs you operate as the main group.

A homeschool group has been asked to add a football program. There are several things to consider.

The IRS is making some changes to their application for tax exempt status, the Form 1023-EZ. What are the changes and how will they affect homeschool groups?

Do you know the difference between nonprofit and tax exempt status?