A new nonprofit corporation. Do they need to reapply for 501c3 status?

A homeschool group wants to be a nonprofit corporation. Do they need to reapply for 501c3 status?

A homeschool group wants to be a nonprofit corporation. Do they need to reapply for 501c3 status?

A homeschool leader wonders if her homeschool co-op can be defined as a "school."

Homeschool leader cannot find her group in the IRS database of exempt organizations.

Homeschool organizations need to have their financial information and organizing documents ready to send into the IRS when asked.

Podcast on how to know if your group's tax exempt status was revoked and how to get it back.

More homeschool organizations receive their tax exempt status from the IRS

Your homeschool group should be filing some reports every year with the IRS. Did you know that?

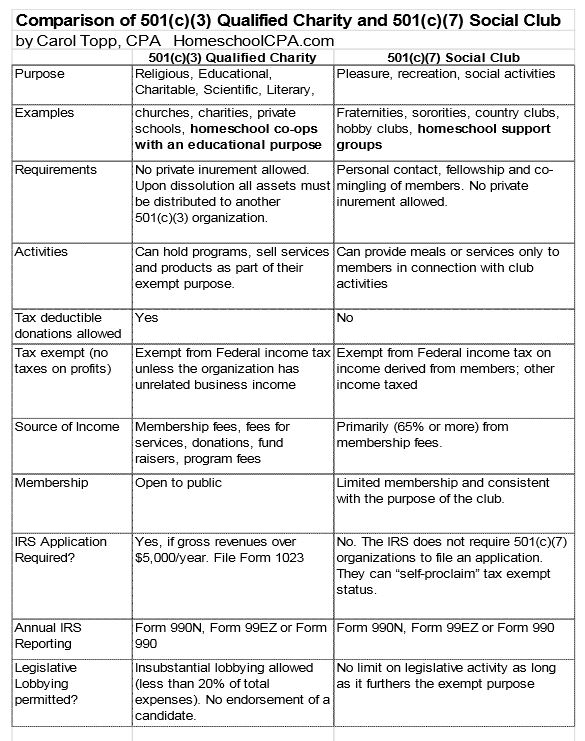

One difference between a homeschool co-op and support group is their tax exempt status in the eyes of the IRS.

Congratulations to Christian Homeschool Organization Interact Connect Encourage (CHOICE) in South Carolina on recently receiving 501(c)(3) tax exempt status with the IRS.

The IRS is getting faster at approving 501(c)(3) tax exempt status for small nonprofits.