New homeschool group wants to avoid paying taxes

A new homeschool leader asks about filing and paying taxes for her group.

A new homeschool leader asks about filing and paying taxes for her group.

Webinar on IRS and state filings for your homeschool nonprofit

How a homeschool nonprofit can self declare tax exempt status.

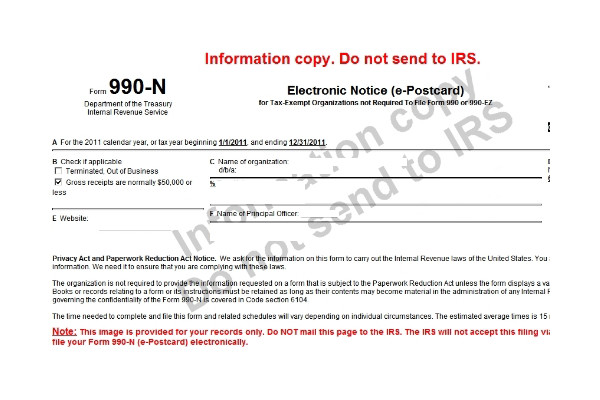

Does a nonprofit need to file a tax return before they receive tax exempt status? Yes, the IRS requires organizations to file information returns before they apply for tax exempt status. Here’s what the IRS website states: Tax Law…

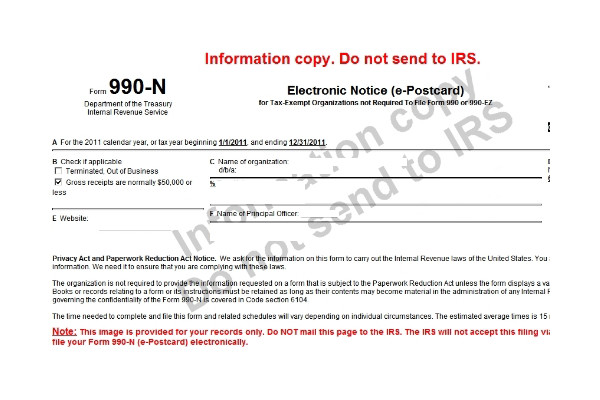

This video shows you what information you need to file the IRS Form 990-N

A report that the IRS requires from all tax exempt organizations--including your group! It's called the Form 990.

Some non-profit organizations have reported trouble trying to file the 990-N ePostcard using the new IRS system.

There is a new website for filing the IRS ePostcard, Form 990-N

Your homeschool group should be filing some reports every year with the IRS. Did you know that?

A homeschool support group knows it needs to file an annual report with the IRS but how?