When someone volunteers you

Have you ever been volunteered by someone else?

Have you ever been volunteered by someone else?

A Classical Conversations Director can give discounts on tuition to an Independent Contractors or employees but there is an important catch!

This guide for homeschool group treasurers covers money management

A homeschool group was was deducting the amount of tuition from the teacher's pay. That's wrong and here's why!

A homeschool group wants to send the parents an invoice and then disperse payments to the teachers

Did your homeschool organization pay an Independent Contractor more than $600 in 2017? Then you need to give them a 1099-MISC form.

What can you do to avoid the IRS penalties on misclassifying employees?

Helping homeschool leaders understand how to classify their workers correctly as employees or independent contractors.

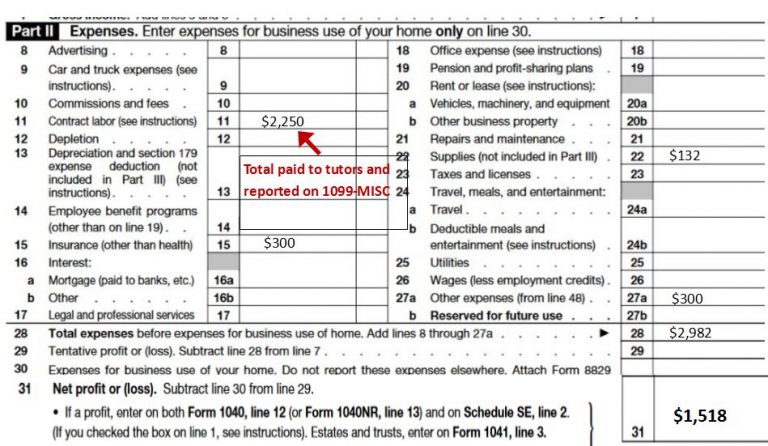

A new Classical Conversations Director asks how to report her income and expenses on her tax return.

Tips for homeschool tutors on their status as an employee or independent contractor.