Homeschool group not open to the public. Is that allowed?

501c3 groups serve a public good but can they limit membership to their group?

501c3 groups serve a public good but can they limit membership to their group?

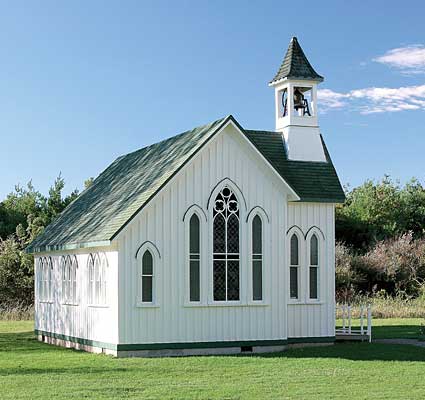

Several homeschool leaders have learned that the way that their homeschool groups are compensating the teachers jeopardizes the property tax exemption of their host churches.

How to manage the money when a homeschool co-op has two locations.

Can a homeschool organization offset a teacher's pay by giving her discount for her child to attend classes?

It's very common got homeschool co-ops and tutorial programs to ask parents to pay the teachers directly

Factors the IRS uses to distinguish between employees and independent contractors including the type of relationship between the worker and the employer.

Since so many homeschool organizations hire workers as Independent Contractors, it might be helpful to examine the difference between employees and independent contractors.

Homeschool expenses are personal expenses and not tax deductions on the federal income tax return.

Hard working volunteers in a homeschool organization, who get a discount on tuition, could have to report and pay taxes on their "compensation."

A homeschool co-op lets their teachers keep unspent class fees. Is this legal?