IRS reports your homeschool group needs to file every year

Your homeschool group should be filing some reports every year with the IRS. Did you know that?

Your homeschool group should be filing some reports every year with the IRS. Did you know that?

A homeschool support group knows it needs to file an annual report with the IRS but how?

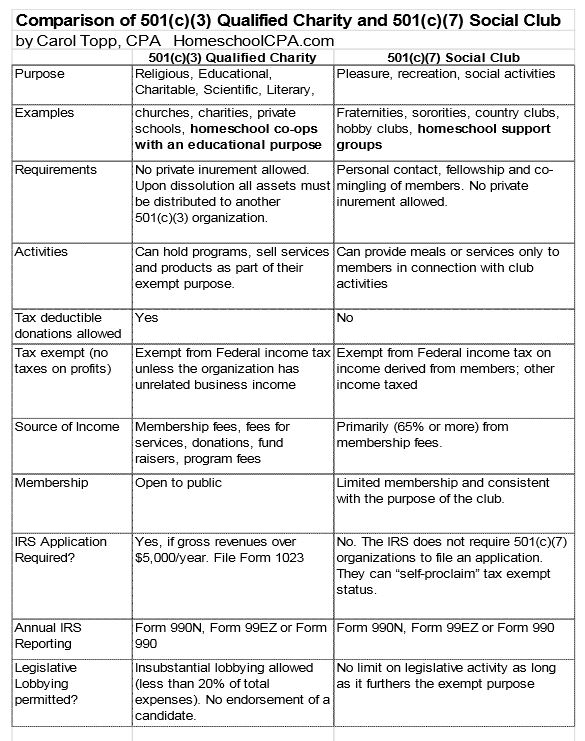

One difference between a homeschool co-op and support group is their tax exempt status in the eyes of the IRS.

The IRS requires all nonprofit organizations to file an annual information return called a Form 990-that means your homeschool group!

Many homeschool organizations may have members participating in their activities (co-op classes, filed trips, clubs, etc), but not have voting members of the corporation. Instead, they have a board that makes the decisions.

What to do if your church-host requires insurance from your homeschool group

A homeschool group wishes to comply with the laws, but is very confused!

One homeschool support group, asks, "What are 'organizing documents' and why does the IRS require them?"

Some helpful information for homeschool support groups from a recent IRS forum.

Current homeschool moms can learn a lot of us graduated homeschool moms if you ask!