Fundraisers for Classical Conversations communities

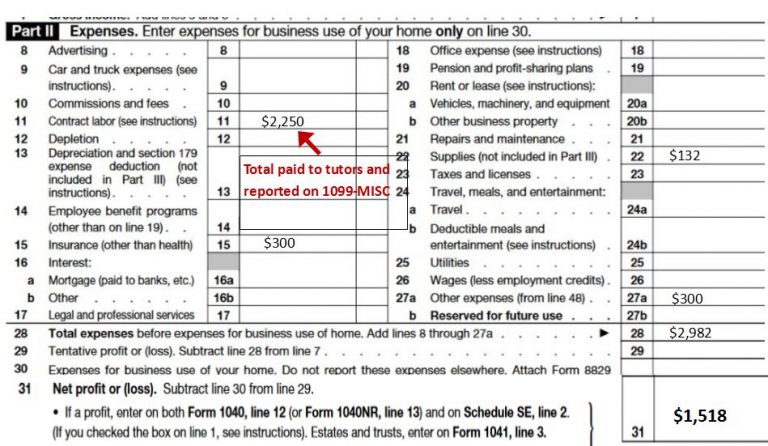

A Classical Conversations (CC) Director posted in a public social media forum this problem regarding fundraising: Our CC campus looked into fundraising but mostavenues did not work for us because we didn’t have nonprofit status. Wespecifically looked at Chick Fil…