Homeschooling and Happy Birthday USA!

I am very appreciative of the freedom we have in the USA to homeschool our children.

I am very appreciative of the freedom we have in the USA to homeschool our children.

In this short podcast Carol Topp CPA explains tax ID numbers and the various state agencies that may assign tax numbers.

A homeschool group incorrectly tells the IRS they are a private foundation.

Your homeschool support group is probably a social club in the eyes of the IRS. Social clubs can get automatic tax exempt status without applying, but they must maintain that tax-free status.

A homeschool treasurer asks if there is a limit to how much money can be in their checking account.

Is it a good idea to start a homeschool co-op with a friend?

How a homeschool group can "self declare" its tax exempt status.

A woman asks if her Classical Conversations homeschool program should be a for-profit business or a nonprofit organization.

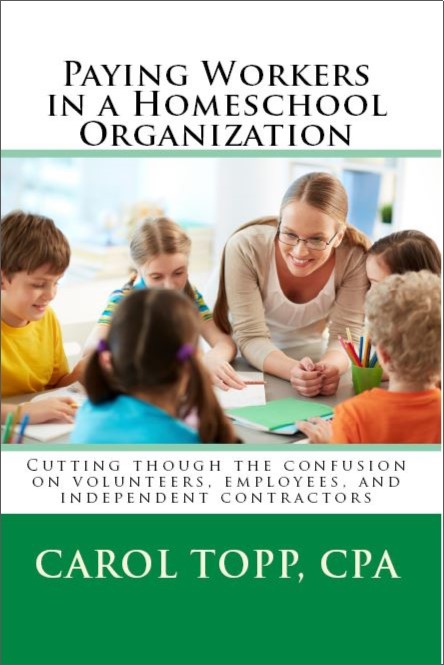

Hiring employees can seem like a taunting task.

n this short podcast, Carol Topp, CPA, the HomeschoolCPA, tells you how to self declare tax exempt status, keep all of your surplus for your group and not pay the IRS.