Policies for Homeschool Co-ops

What types of policies should your homeschool co-op have?

What types of policies should your homeschool co-op have?

What is the difference with between Classical Conversations tutors and online tutors in the eyes of the IRS?

Carol Topp, the HomeschoolCPA, answers questions from homeschool leaders about insurance.

If a homeschool is a private school can the parent use 529 funds for K-12 expenses?

Carol Topp, CPA offers advice and tips on important topics to running a successful group.

Donors who give to your nonprofit expect that 100 percent of their gift will be used to support your mission.

The benefits of forming your homeschool co-op as a nonprofit corporation

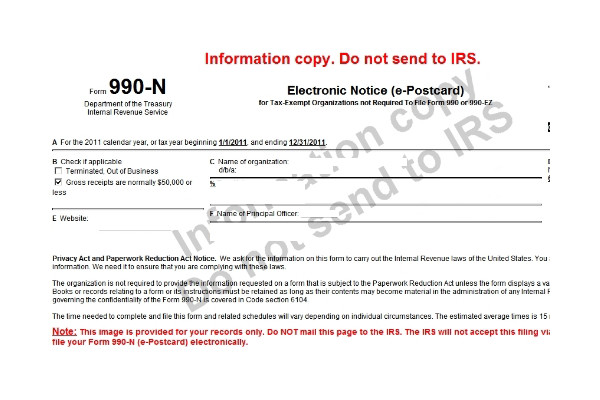

This video shows you what information you need to file the IRS Form 990-N

Having a mission will help you focus and avoid burning out.

Homeschool parents may be able to use 529 funds for K-12 expenses, but follow the rules.