Leading a Large Homeschool Co-op

Advice on running a large homeschool co-op successfully.

Advice on running a large homeschool co-op successfully.

Do you know how to keep the children in your homeschool group safe?

5 more ways to avoid burnout as you lead your homeschool organization.

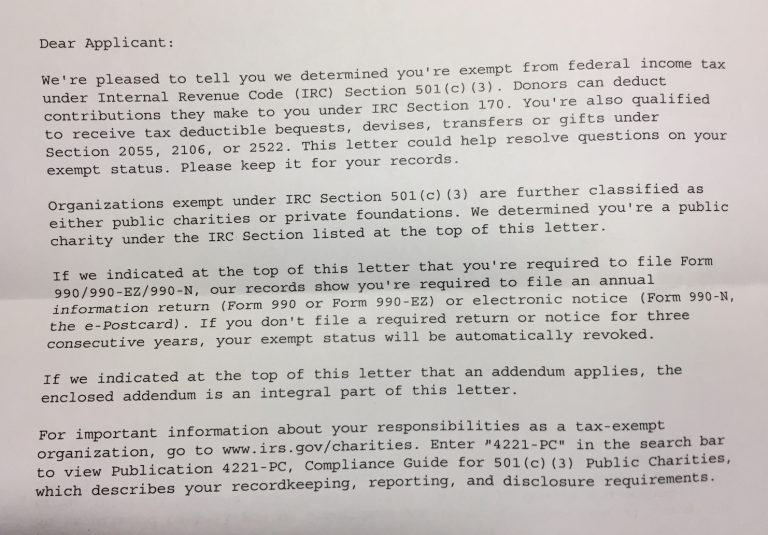

The IRS tells a small homeschool group that they cannot accept tax-deductible donations.

5 ways to avoid burnout as you lead your homeschool group.

From the I Am a Homeschool Group Leader Facebook group (if you’re not a member yet request to join us. We’d love to have you!) How does your group handle old financial records? What do you keep, what gets…

Tips and advice for dealing with conflict in your homeschool co-op.

The IRS has added additional questions and a description of activities to the Form 1023-EZ application for tax exempt status.

How to recruit leaders to help you run your homeschool co-op.

There may be a way for homeschoolers to use their 529 savings accounts for some K-12 expenses.