Can my homeschool group collect money now that’s for next year?

How should early deposits be recorded in a homeschool group's bookkeeping?

How should early deposits be recorded in a homeschool group's bookkeeping?

A podcast episode that explains the difference and why it matters how you classify your homeschool group's workers.

Crediting scrip rebates toward tuition or other fees has been reviewed and approved by the IRS

A podcast episode that explains the difference and why it matters how you classify your homeschool group's workers.

Homeschool business owners can learn how to prepare their tax returns

Helping homeschool leaders know the tax rules about fundraisers.

Can a landlord can claim a deduction for the reduced rent she gives to a homeschool group?

Helping homeschool leaders understand how to classify their workers correctly as employees or independent contractors.

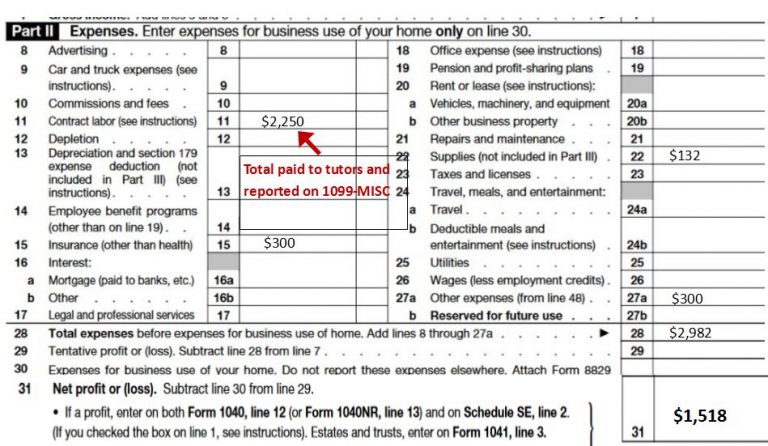

A new Classical Conversations Director asks how to report her income and expenses on her tax return.

Helping homeschool leaders know what to do if their organization has lost its tax exempt status.