Should a Classical Conversations Director be an LLC?

The reason that most businesses use the LLC structure is for limited liability.

The reason that most businesses use the LLC structure is for limited liability.

Should a homeschool program director include her children's tuition as income on her tax return?

A Classical Conversations Director can give discounts on tuition to an Independent Contractors or employees but there is an important catch!

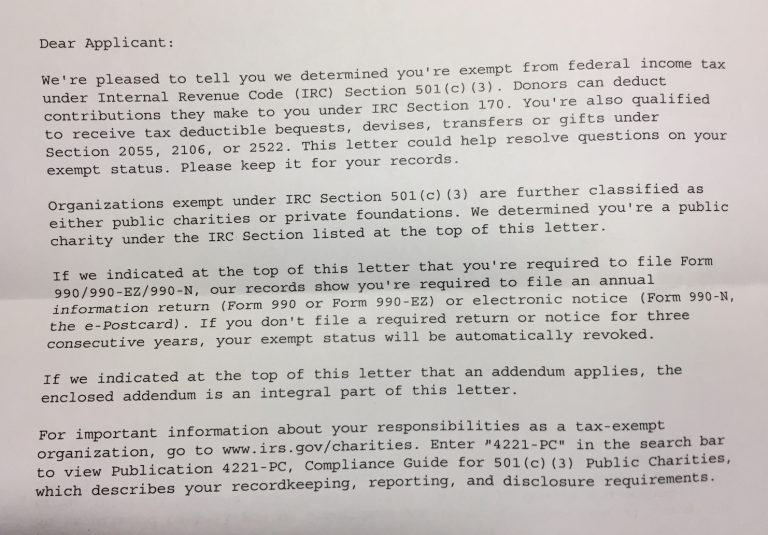

The IRS claimed a small charity should have filed the longer Form 1023.

Homeschool leader, Paula, was applying for an EIN (Employer Identification Number) online, but the IRS website asked for her SSN (Social Security Number). She is reluctant to give it out. Should she be concerned? Someone (the “responsible party”) must…

This book is for anyone who mistakenly thinks they don't have to do any annual reports to the IRS.

If a homeschool is a private school can the parent use 529 funds for K-12 expenses?

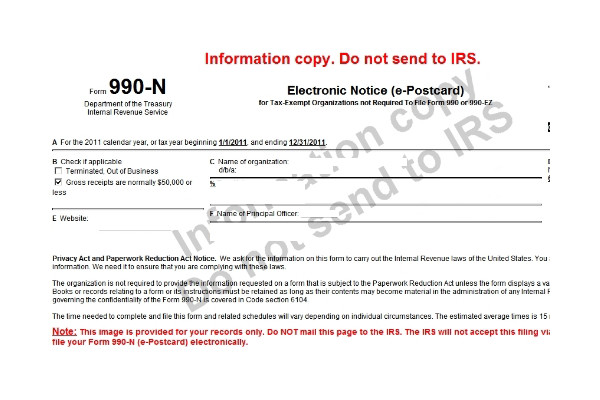

This video shows you what information you need to file the IRS Form 990-N

The IRS tells a small homeschool group that they cannot accept tax-deductible donations.

There may be a way for homeschoolers to use their 529 savings accounts for some K-12 expenses.