Church is worried about legal status of homeschool group

It's nicest if the church accepts a homeschool group as a ministry, but for legal and insurance purposes a lot of churches are reluctant to do that.

It's nicest if the church accepts a homeschool group as a ministry, but for legal and insurance purposes a lot of churches are reluctant to do that.

Error in the IRS and Your Homeschool Organization book

Two homeschool organizations received their 501(c)(3) tax exempt status with the IRS.

Two homeschool organizations received their 501(c)(3) tax exempt status with the IRS.

Do you get a new number when your nonprofit becomes a 501c3?

A homeschool leader wonders if his 501c3 organization can lobby against legislation harmful to homeschooling.

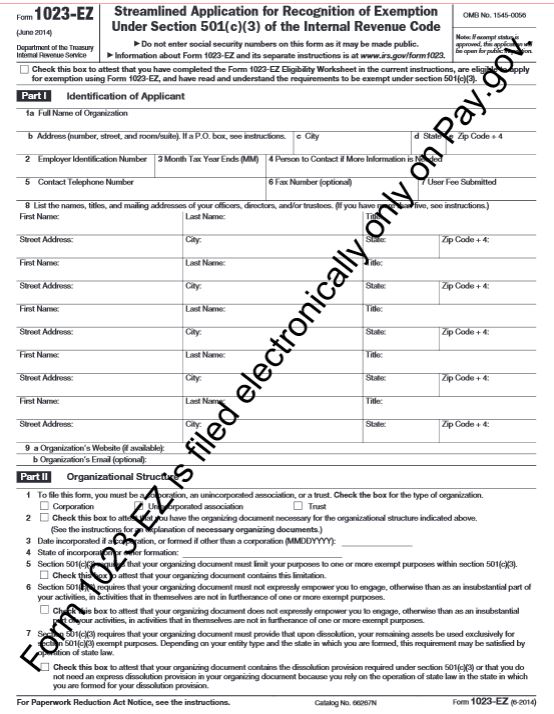

This new IRS form will make applying for tax exempt status much easier for small nonprofits.

Did your nonprofit organization lose your tax exempt status? What’s this all about? In 2010, the IRS has begun revoking the tax-exempt status nonprofit organizations that failed to file a Form 990/990EZ or 990N for three years. A large number…

My leadership team is freaking out. We are one of those groups in the 990N discussion. We got our EIN in June 2010 and opened a checking account in December 2010. We always have under $5,000 pass through our books…

Be careful about what you are agreeing to when you check the box stating your nonprofit homeschool corporation has members.