How to get added to the IRS database and file the Form 990N

A homeschool support group knows it needs to file an annual report with the IRS but how?

A homeschool support group knows it needs to file an annual report with the IRS but how?

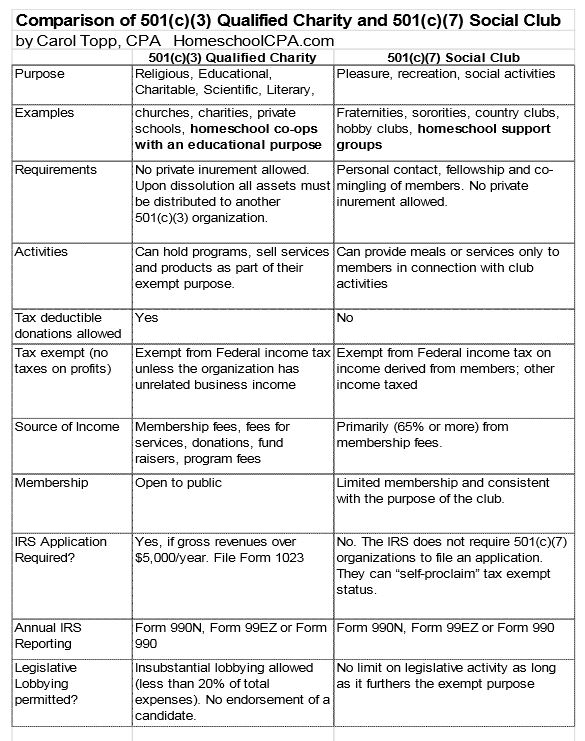

One difference between a homeschool co-op and support group is their tax exempt status in the eyes of the IRS.

A homeschool group applies for one tax exempt status and the IRS switches them to another.

A homeschool support group leader wonders what forms she needs to file each year.

A homeschool group wishes to comply with the laws, but is very confused!

Carol Topp discusses tax exemption for homeschool groups on her internet radio show Dollars and Sense, part of the Ultimate Homeschool Radio Network.

One homeschool support group, asks, "What are 'organizing documents' and why does the IRS require them?"

The IRS would like all nonprofit including homeschool support groups to be filing the Form 990N postcard.

The IRS states that 501c7 Social clubs can self declare their tax exempt status.

A homeschool leaders looks for official IRS statement on 501c7 social club status.