Can we get an EIN without giving a name and SSN?

Homeschool leader is uncomfortable about putting her Social Security Number on her co-op's EIN application.

Homeschool leader is uncomfortable about putting her Social Security Number on her co-op's EIN application.

Get a free copy of QuickBooks 2015 Premiere Nonprofit software package.

Carol Topp discusses the 3 essential tools that homeschool leaders need in this video clip.

Do you know the pros and cons of 501(c) tax exempt status? Do you know what tax exempt status could mean for your homeschool group?

Carol Topp shares 3 traps homeschool leaders need to avoid in this video clip

A homeschool teacher asks, "Can I work off my co-op fees by teaching a class?" (the answer is no)

Carol Topp discusses the pros and cons of leading a homeschool co-op and your responsibility as its leader in this video clip on Tips and Traps for Homeschool Leaders

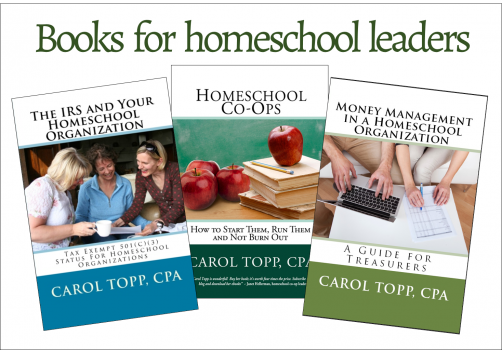

Have you benefited from reading any of my books? Would you please leave a short blurb on Amazon?

Congratulations to two homeschool organizations that recently received tax exempt status with the IRS!

The IRS requires all nonprofit organizations to file an annual information return called a Form 990-that means your homeschool group!