Preparing Strong Independent Contractor Agreements

Having a good, strong independent contractor agreement for your homeschool organizations is important.

Having a good, strong independent contractor agreement for your homeschool organizations is important.

A discussion on using PayPal to collect fees in a homeschool group.

What is your homeschool group, a co-op, a support group, or something else?

A homeschool leader wonders if her homeschool co-op can be defined as a "school."

Homeschool mom has an idea for a homeschool enrichment program.

Carol, Our homeschool group is a 501c3 organization. A parent member of our group recently approached me and asked if we could start a scholarship program. (This would not be a college scholarship program.) The parent’s hope is that…

Homeschool organizations need to have their financial information and organizing documents ready to send into the IRS when asked.

A homeschool leader wants to change her co-op's fiscal year.

Your homeschool group should be filing some reports every year with the IRS. Did you know that?

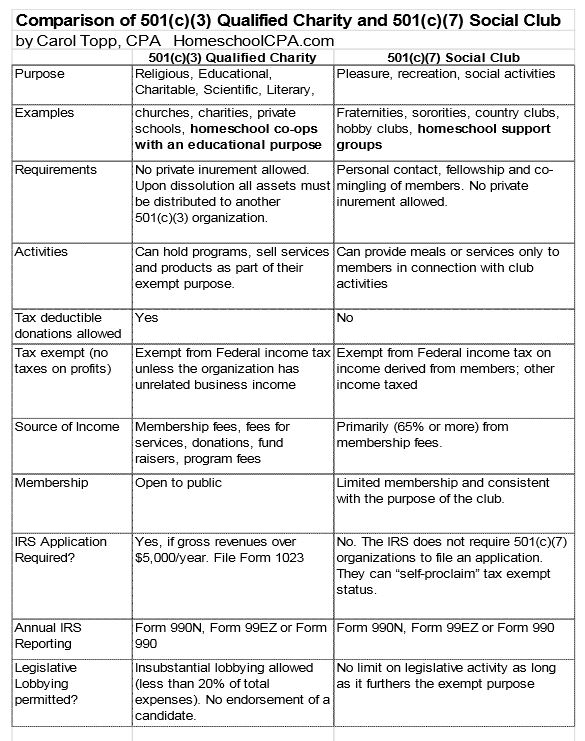

One difference between a homeschool co-op and support group is their tax exempt status in the eyes of the IRS.