Is your homeschool group’s hired teacher really an employee?

A homeschool group faced an unpleasant audit by the IRS for misclassifying their co-op teachers as independent contractors.

A homeschool group faced an unpleasant audit by the IRS for misclassifying their co-op teachers as independent contractors.

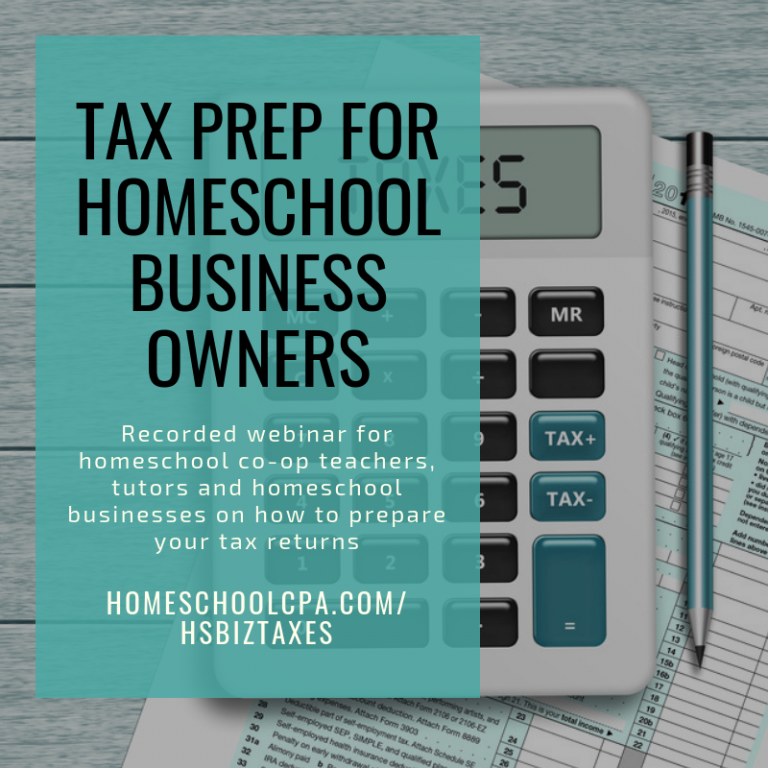

What business structure and tax forms are needed for a new homeschool co-op?

Paying co-op leaders in a homeschool group

I subscribe to a lot of e-newsletters and a really good one is Free Church Accounting. Vicki Boatright has helpful bookkeeping advice for churches and nonprofits like homeschool groups! Her latest article is about classifying workers as employees or Independent…

Can a homeschool group gather all the money and then direct it to each teacher?

California’s new law (AB5) puts into affect the 2018 ruling by the California Supreme Court in the Dynamex case that makes it more difficult to treat workers as Independent Contractors. The new law uses an ABC test introduced in the…

Lots of homeschool groups hire and pay teachers to conduct classes. Sometimes these teachers are homeschool parents, but sometimes they are professional instructors. Homeschool leaders have a lot of questions about paying teachers and other workers. Topics in this episode…

The IRS is looking at nonprofit organizations who convert from for-profit businesses and misclassify workers.

Here are the top tax mistakes homeschool for-profit directors and owners make.

There's a new tax deduction for business owners in 2018!