Could you please give me a minute (and review my books)?

Have you benefited from reading any of my books? Would you please leave a short blurb on Amazon?

Have you benefited from reading any of my books? Would you please leave a short blurb on Amazon?

Does getting an EIN mean you must file a return with the IRS?

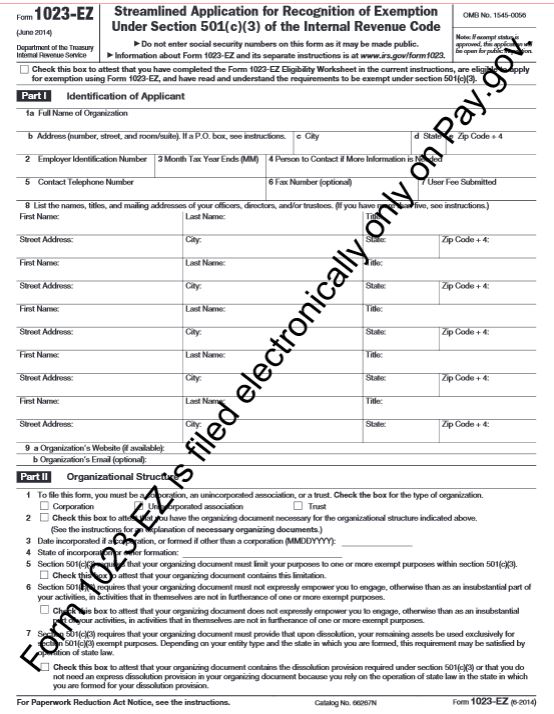

Did you know the IRS recently (July 1, 2014) released a new, shorter application for 501(c)(3) tax exempt status?

The IRS requires all nonprofit organizations to file an annual information return called a Form 990-that means your homeschool group!

A tutored hired to teach a homeschooled student wonders if she is am employee of the family who hired her.

Two homeschool organizations received their 501(c)(3) tax exempt status with the IRS.

Two homeschool organizations received their 501(c)(3) tax exempt status with the IRS.

List of IRS approved providers for filing prior year Form 990N

This new IRS form will make applying for tax exempt status much easier for small nonprofits.

Did your nonprofit organization lose your tax exempt status? What’s this all about? In 2010, the IRS has begun revoking the tax-exempt status nonprofit organizations that failed to file a Form 990/990EZ or 990N for three years. A large number…