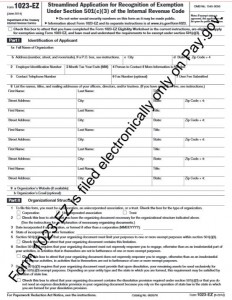

Did you know the IRS recently (July 1, 2014) released a new, shorter application for 501(c)(3) tax exempt status?

It’s great. I’ve helped about 3 organizations apply for tax exempt status using the new, online Form 1023-EZ and we love it!

TaxAnaylsts.com recently interviewed IRS Commissioner John Koskinen on several issues including the new Form 1023-EZ which will make applying for tax exempt status much easier for small organizations (gross revenues under $50,000 per year). That includes a lot of homeschool co-ops and other educational organizations!

Here are some interesting excerpts (Mr Koskinen rambles a bit, so I did edit out some repetitions)

IRS reason for creating a shorter application form for small nonprofits

“Our existing problem is, it takes these organizations of any size, and certainly small ones, up to a year, over a year, to get approved. And I was concerned when I started and discovered we had a backlog of over 60,000. I was surprised that hadn’t become a bigger issue, because that is a big problem.

“It’s unfair to people who actually want to get through the process. It puts a lot of pressure on people. ..even if you’re going to have a small PTA or somebody, we’re going to give you the same fun-filled examination that Bill Gates has when he puts up his — it doesn’t make any sense. The risk to the public is much greater, and larger organizations are going to be much more complicated and allegedly doing more. And the benefit to the public is deprived by people not being able to get running and do things.

“…we’ve spent a lot of time designing that form to make sure we collect the information that we need.It will be for the first time, digital, online, so we can actually screen the applications and the answers, to pick up ones that we want to take a look at before we give approval to because we’ll know which answers are inconsistent, which ones raise questions, even though they answer them or are supposed to answer them in a way that allows you to get through without more review. So that we will have, for the first time, these applications as opposed to the old forms, we’ll be electronic and we’ll be able to screen them and analyze, as I say, of the 60,000, probably 45,000 are small. We’ll have a lot more control over the 45,000, by simply being able to screen them.

IRS plans to put some nonprofit organizations through the process of the longer Form 1023

“The second thing we’re going to do, because in some ways it’s a pilot project, is we’re going to take a statistical sampling of the applications and put them through the more rigorous process, to see if they’ve answered the questions correctly, or whether they’ve, in fact, if they’d gone through the 26-page questionnaire, would have been not qualified, whereas that looks like they’re qualified. So we’ll actually do — I don’t know how many hundred we’ll do, but we’ll take a reasonable number of them at the front end and just put them through the process and see how accurate is the short form. (my emphasis added)

The IRS will initiate a follow up to see if small charities are doing what they said they would do.

“We also are going to spend — take another statistical sample, once they’re out a year, and go out and audit how they’re doing and what are they doing. So they won’t be the same people we know are doing the right thing, because we’ve put them through the 26-page. There will be another set of people who we say, OK, this is what they said they were going to do. They filled out this form. What are they actually doing? And we’ll actually spend more time finding out what they’re actually doing than we do for a lot of them. You know, we have a million, six hundred thousand, 501(c) organizations out there up and running. (my emphasis added)

A more efficient IRS

“And so part of the theory is that (a) we’ll be much more efficient at the front end with the 80 percent of applications that are small, and be able to screen them out more effectively than we have, and we’re going to actually look at them at the front end and look at them a year later, and adjust accordingly.

The automatic revocation of tax exempt status created a need for a simpler reinstatement process.

“The bulk of the organizations are small ones. What happens with small ones is revealed. You know, the Congress passed a law that said if you didn’t file a [Form] 990 for three years, it got revoked. So we revoked 550,000. And 46,000 asked for reinstatement. …The bulk of what happens with these people, not surprisingly, is they start up and they are running whatever they’re doing and they don’t get a lot of funding or somebody decides to move and they just go away. And in fact, one of the advantages of that program — and then we got to streamline a way of getting people back in if they want to — has been, part of the problem, I’ve discovered, with the risk and the problem we have now, is that because it takes so long and costs so much, there’s a gray market in old 501(c)(3)s.

IRS hopes result is less risk to the public and more charitable work being done.

“So I think when you get done with it, as I say, we’re looking for the risks in trying to make sure that there is a problem that we’ll know. We’re also monitoring volume. You know, the theory was we’re going to go over everybody and his uncle who is now going to be a 501(c)(3). Thus far, the pace of applications is consistently the pace in the past. We’ve seen no uptick. But we’re monitoring that as well. But say, OK, are we now getting a lot more — suddenly everybody’s becoming more charitable, and they’ve got new organizations or not. And so we’ll find that.

But the net result is that there will be less risk to the public, that people are getting the benefit of tax exemption and contributions for what they’re doing because we will spend — have more resources available. We’ll be better at the front end, but we’ll have more resources available to check on people at the back end and see are you doing what you said you were going to do. Are you still doing the right thing? Now we’ll know.

One of the things we’re working on is how we can make better use of the 990s, which are, you know, self-reporting, but they give you some indication of where you are. But the real answer is you need to go out and write people notes and say hey, what are you up to, what are you doing, what’s going on? So I think the net result is we’ll have less risk to the public by better using our resources.”

So you made it to the end of reading all that! I’m impressed!

If you think your nonprofit organization is eligible for 501(c)(3) tax exempt status using the new shorter form, please contact me and we can discuss your situation.

Carol Topp, CPA