Homeschool business owner under reporting her income

A homeschool business owner asks, "Why do I have to claim all of the money even though I don’t keep it?"

A homeschool business owner asks, "Why do I have to claim all of the money even though I don’t keep it?"

A homeschool group doesn't want tax exempt status.

The IRS determinations on worker status is based on common law, not scientific facts.

Does a nonprofit need to file a tax return before they receive tax exempt status? Yes, the IRS requires organizations to file information returns before they apply for tax exempt status. Here’s what the IRS website states: Tax Law…

Some homeschool groups are very small and are not interested in the benefits of 501 c3 tax exempt status such as accepting donations or doing fundraising. Do these small homeschool groups really need 501c3 tax exempt status? No. They…

The IRS claimed a small charity should have filed the longer Form 1023.

Homeschool leader, Paula, was applying for an EIN (Employer Identification Number) online, but the IRS website asked for her SSN (Social Security Number). She is reluctant to give it out. Should she be concerned? Someone (the “responsible party”) must…

This book is for anyone who mistakenly thinks they don't have to do any annual reports to the IRS.

If a homeschool is a private school can the parent use 529 funds for K-12 expenses?

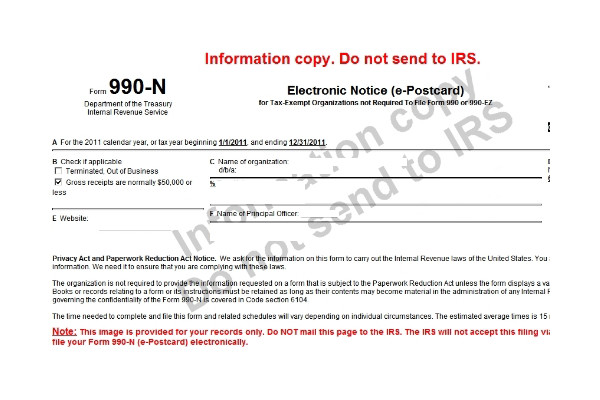

This video shows you what information you need to file the IRS Form 990-N