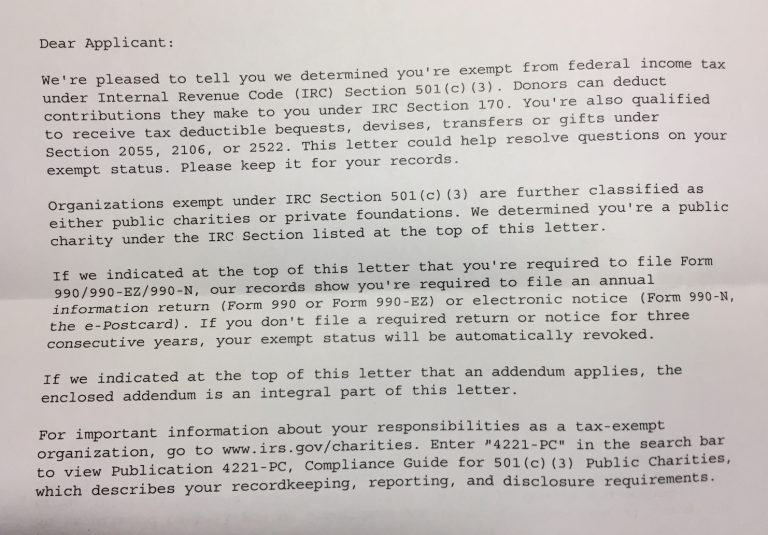

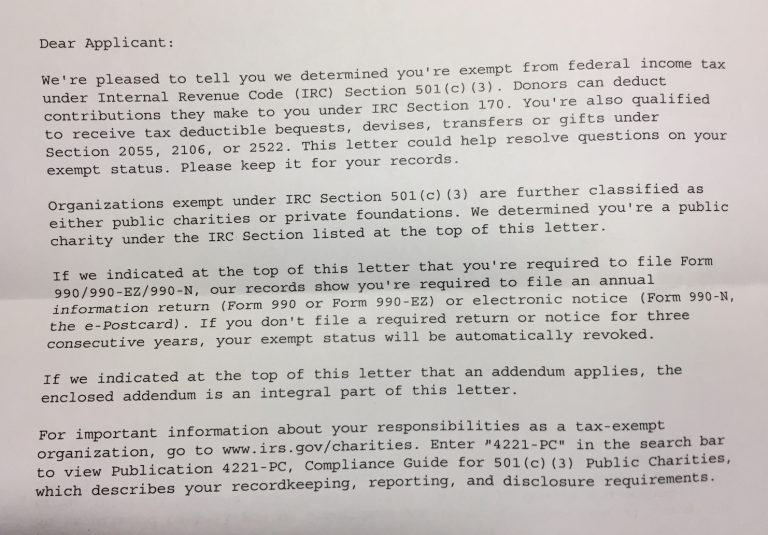

Tax deductible donations without IRS determination letter

The IRS tells a small homeschool group that they cannot accept tax-deductible donations.

The IRS tells a small homeschool group that they cannot accept tax-deductible donations.

Here’s a list of homeschool expenses you can deduct on your federal income tax return (Form 1040)

A homeschool group was was deducting the amount of tuition from the teacher's pay. That's wrong and here's why!

I just sent the final version of Taxes for CC Licensed Directors off!

Carol Topp, CPA answered this question originally back in 2014, but the answer is still the same-even with the new tax laws passed in 2017.

Tips on how to find a local tax professional

A social club wonders who they have to give a 1099-MISC to.

A homeschool leader has a tax mess when Payal thinks she made $40,000!

Can a homeschool co-op pay teachers as Independent Contractors and be in accordance with the IRS rules?

The IRS is making some changes to their application for tax exempt status, the Form 1023-EZ. What are the changes and how will they affect homeschool groups?