Checklist for homeschool co-op

Checklist for Homeschool Organizations Applying for Tax Exempt Status.

Checklist for Homeschool Organizations Applying for Tax Exempt Status.

IRS lowers fees on Form 1023-EZ

A homeschool group can gather without needing to file reports with the IRS, but they will be limited.

A fundraiser can bring in so much income that it can jeopardize your 501c7 status because the fundraiser income exceeds 35% of total income.

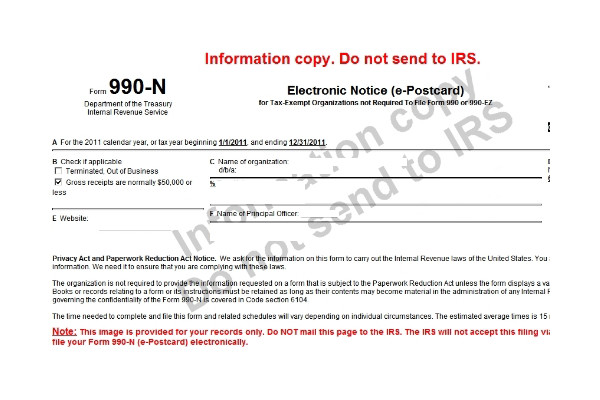

There is a new website for filing the IRS ePostcard, Form 990-N

Hard working volunteers in a homeschool organization, who get a discount on tuition, could have to report and pay taxes on their "compensation."

The IRS offers several exceptions to Unrelated Business Income Tax

A homeschool co-op lets their teachers keep unspent class fees. Is this legal?

The story of a small homeschool support group that grew into a full-fledged nonprofit organization

Several homeschool organizations were granted 501(c)(3) tax exempt status by the IRS