Do the new overtime rules affect homeschool groups?

Read the exceptions to the new overtime rules for nonprofits.

Read the exceptions to the new overtime rules for nonprofits.

Your homeschool organization can pay a volunteer, but the pay must be reported to the IRS.

Free or reduced tuition may be taxable compensation to your board members.

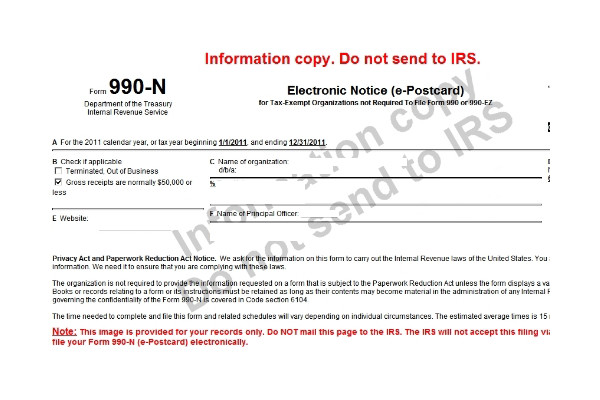

There is a new website for filing the IRS ePostcard, Form 990-N

The IRS offers several exceptions to Unrelated Business Income Tax

Homeschool organizations cannot accept tax deductible donations until they have 501c3 tax exempt status.

What should a homeschool group do when given a donation?

Steps to create a budget by using last year's actual spending.

A Classical Conversations director wants nonprofit status for her CC Community.

A homeschool group wants to be a nonprofit corporation. Do they need to reapply for 501c3 status?