We don’t want 501c3 status. Should we still include the IRS language in the Articles?

A homeschool group doesn't want tax exempt status.

A homeschool group doesn't want tax exempt status.

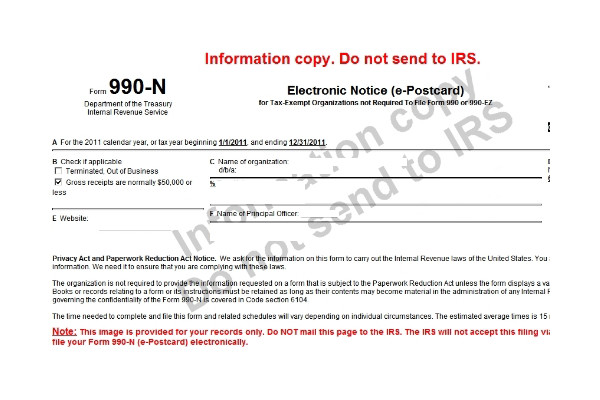

This book is for anyone who mistakenly thinks they don't have to do any annual reports to the IRS.

This video shows you what information you need to file the IRS Form 990-N

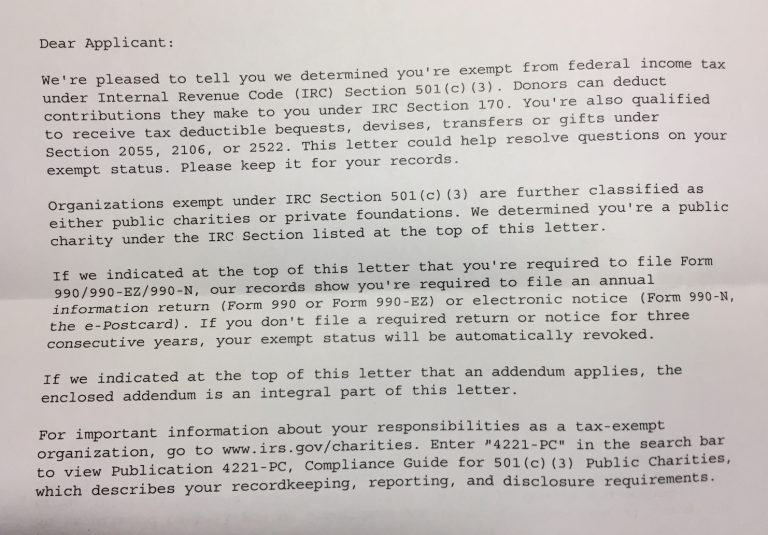

The IRS tells a small homeschool group that they cannot accept tax-deductible donations.

A homeschool group has to cancel classes. What should they do with the dues already paid?

The IRS is making some changes to their application for tax exempt status, the Form 1023-EZ. What are the changes and how will they affect homeschool groups?

A church worries that letting a classical homeschool program use their building threatens its property tax exemption.

Do you know the difference between nonprofit and tax exempt status?

Terms like 501c3, association, nonprofit and tax exempt can be confusing.

Carol Topp, CPA answers questions from homeschool leaders about self-declaring tax exempt status for your homeschool support group.