How to close down an EIN for a tax exempt organization

Your nonprofit organization may need to close an old EIN. Here's how.

Your nonprofit organization may need to close an old EIN. Here's how.

IRS lowers fees on Form 1023-EZ

501c3 groups serve a public good but can they limit membership to their group?

Several homeschool leaders have learned that the way that their homeschool groups are compensating the teachers jeopardizes the property tax exemption of their host churches.

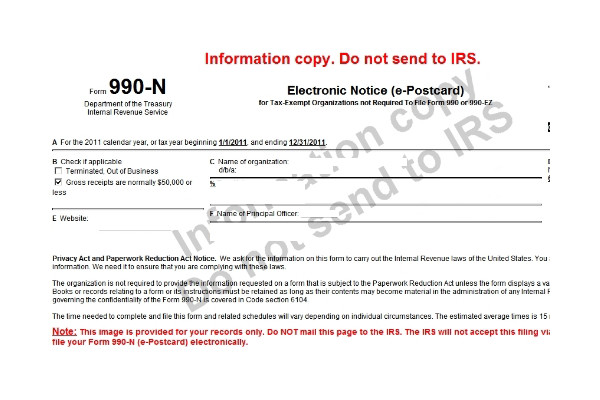

There is a new website for filing the IRS ePostcard, Form 990-N

The story of a small homeschool support group that grew into a full-fledged nonprofit organization

Several homeschool organizations were granted 501(c)(3) tax exempt status by the IRS

Carol Topp, CPA the author of Homeschool Co-ops: How to Start Them, Run Them and Not Burn Out covers more tips to starting a homeschool co-op in her podcast.

A Classical Conversations director wants nonprofit status for her CC Community.

A homeschool group wants to be a nonprofit corporation. Do they need to reapply for 501c3 status?