Is the rent our homeschool group pays to a church a donation?

A church wants the homeschool co-op to call their rent payment a donation. Is that correct?

A church wants the homeschool co-op to call their rent payment a donation. Is that correct?

Can a homeschool group owe tax from a used curriculum sale fundraiser?

What can you do to avoid the IRS penalties on misclassifying employees?

Ways to thank your volunteers that are tax-free.

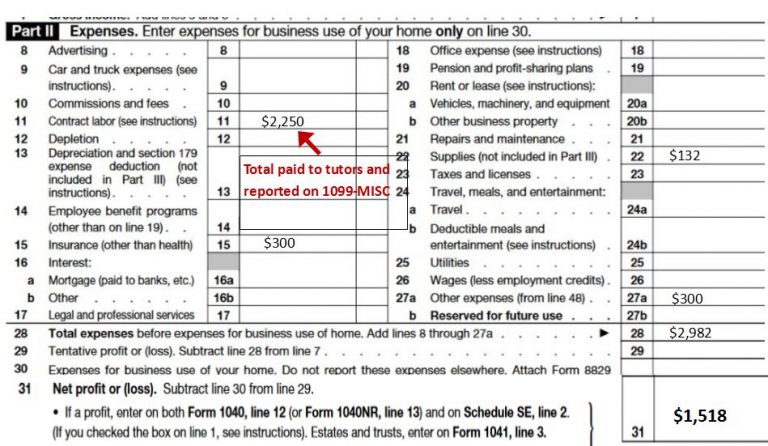

Homeschool business owners can learn how to prepare their tax returns

A new Classical Conversations Director asks how to report her income and expenses on her tax return.

A homeschool co-op teacher asks where she reports her income from teaching.

Are educational classes like violin lessons and ballet classes tax deductions?

April 15 was a little late for a Classical Conversations Director to ask if she needed to file any forms with the IRS!

Homeschool leaders will know if they are paying their volunteers, board members and workers legally and correctly.