Opening another branch of a homeschool co-op

How to manage the money when a homeschool co-op has two locations.

How to manage the money when a homeschool co-op has two locations.

Can a homeschool organization offset a teacher's pay by giving her discount for her child to attend classes?

It's very common got homeschool co-ops and tutorial programs to ask parents to pay the teachers directly

Factors the IRS uses to distinguish between employees and independent contractors including the type of relationship between the worker and the employer.

Since so many homeschool organizations hire workers as Independent Contractors, it might be helpful to examine the difference between employees and independent contractors.

Help for homeschool leaders in understanding if workers are employees or independent contractors.

Some states offer tax breaks for homeschoool expenses

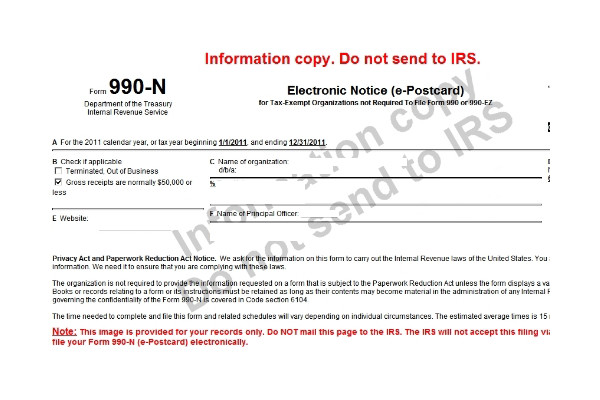

There is a new website for filing the IRS ePostcard, Form 990-N

Homeschool expenses are personal expenses and not tax deductions on the federal income tax return.

Hard working volunteers in a homeschool organization, who get a discount on tuition, could have to report and pay taxes on their "compensation."