Carol,

I wanted to check with you about a sentence that is in our Independent Contractor Agreement. No one has ever given us a W-9 before even though they have signed our agreement. Why are the contractors submitting any tax related information to us? I thought they were to complete all of that completely on their own. Is that part necessary?Thank you so much!!!

Tanya B

Tanya,

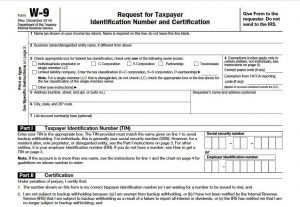

The W-9 is the official way to collect an Independent Contractor’s name and SSN or business name and EIN (Employer Identification Number). This information is needed if you pay them over $600 a year and issue them a 1099-MISC.

You can get the Form W-9 from the IRS website.

The W-9 is also the unofficial way to determine if you are dealing with ethical people. Some people do not like giving their information on a W-9 because they were not going to report the income on their tax return. Having them fill in a W-9 indicates that your organization obeys the law and expects them to obey the law as well.

Your organization keeps a copy of the W-9 filled in by the Independent Contractor. You do not sent it into the IRS.

Have more questions about paying workers in your homeschool organization? My book Paying Workers in a Homeschool Organization will help!

Carol Topp, CPA

HomeschoolCPA.com