I see a lot of financial reports from homeschool groups. Some are clear, easy to understand and helpful to the board members.

Others are a confused mess.

Read about the most common record keeping mistakes that homeschool groups make and how to correct them in my book Money Management in a Homeschool Organization

Recently, I looked over a financial report from a large homeschool organization. They had two goals:

- Make the financial statements easy to read and helpful to their board.

- Make it easy to prepare their annual Information return, IRS Form 990. Because their financial reports were confusing, I spent extra time and money reclassifying their information to fit the IRS annual information return.

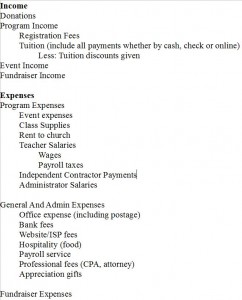

I recommended that this homeschool organization create a Chart of Accounts similar to the IRS Form 990 and other nonprofit organizations.

Organizing the Chart of Accounts by categories and using subcategories and indents will make the financial reports easier to read and understand. This Chart of Accounts clearly separates Program Expenses and Administrative Expenses. Categories and subcategories can be added as needed, but I encouraged the organization to keep the list short to make it easier to read the financial statements.

This organized report will make preparing the Form 990 easier (and less expensive).

Carol Topp, CPA

Can’t agree more– not only will this immediately help you get organized in the short term, it will make financial organization vastly easier in the long run.