Good, Fast And Cheap: Can a Homeschool Co-op Be All Three?

A homeschool co-op offers drop-off high school classes and wants to remain high quality and low cost. Can they do all three?

A homeschool co-op offers drop-off high school classes and wants to remain high quality and low cost. Can they do all three?

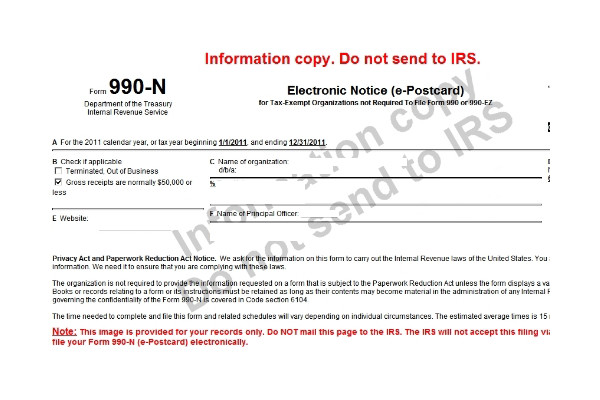

This book is for anyone who mistakenly thinks they don't have to do any annual reports to the IRS.

What types of policies should your homeschool co-op have?

What is the difference with between Classical Conversations tutors and online tutors in the eyes of the IRS?

Carol Topp, the HomeschoolCPA, answers questions from homeschool leaders about insurance.

If a homeschool is a private school can the parent use 529 funds for K-12 expenses?

Carol Topp, CPA offers advice and tips on important topics to running a successful group.

Donors who give to your nonprofit expect that 100 percent of their gift will be used to support your mission.

The benefits of forming your homeschool co-op as a nonprofit corporation

This video shows you what information you need to file the IRS Form 990-N