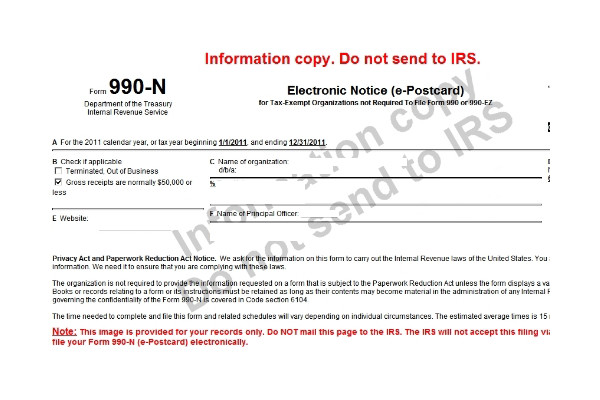

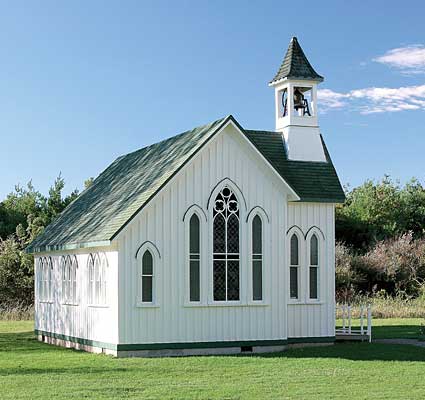

How you pay your homeschool teachers could affect the property tax exemption for your host church

Several homeschool leaders have learned that the way that their homeschool groups are compensating the teachers jeopardizes the property tax exemption of their host churches.