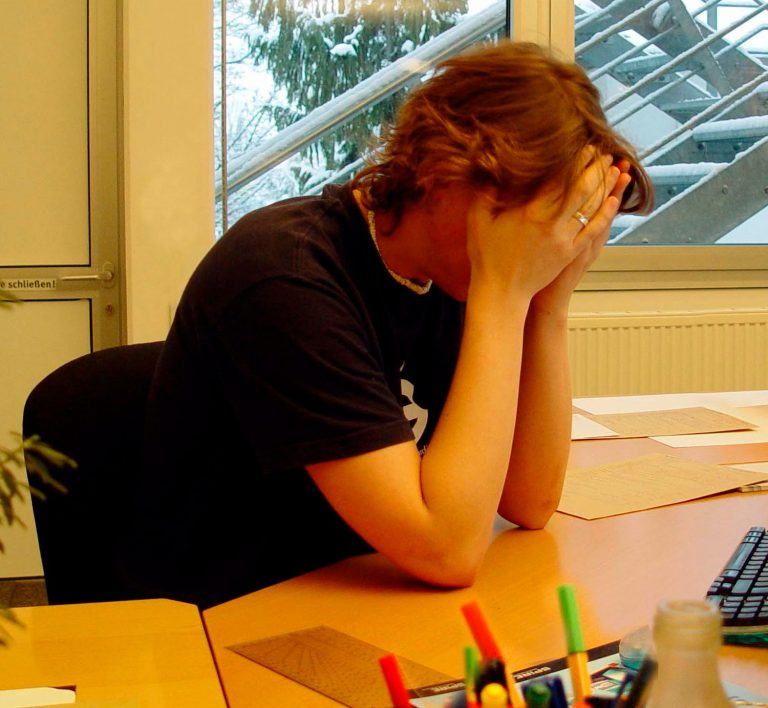

Why is being a homeschool group leader so exhausting and thankless?

On the Facebook group I am a Homeschool Group Leader, Lesley asks, Why is being a homeschool group leader so exhausting and thankless? Here are some replies from other homeschool group leaders (my emphasis added). Jennifer: Because those you are…