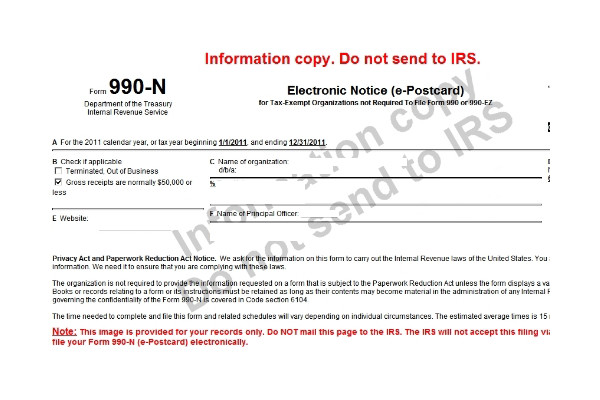

How to file the IRS Form 990-N video

This video shows you what information you need to file the IRS Form 990-N

This video shows you what information you need to file the IRS Form 990-N

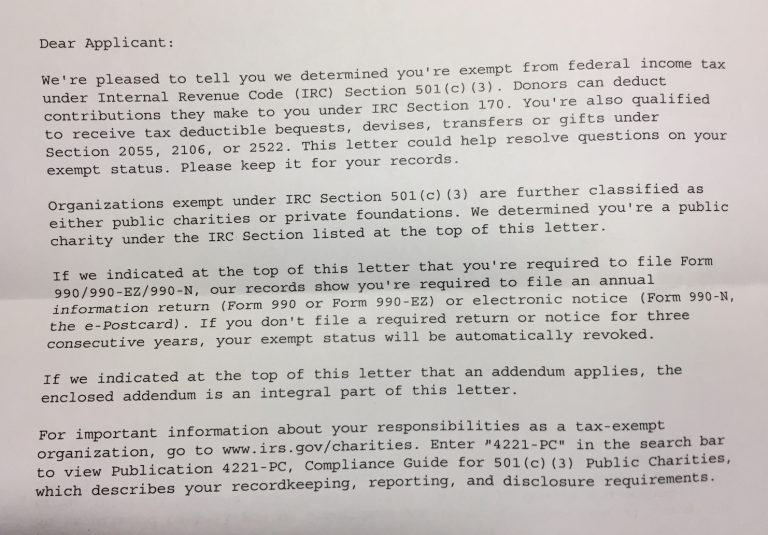

The IRS tells a small homeschool group that they cannot accept tax-deductible donations.

The IRS has added additional questions and a description of activities to the Form 1023-EZ application for tax exempt status.

Adding a football program to your homeschool group does not mean it is a separate legal identity. It can be one of the programs you operate as the main group.

A homeschool group has been asked to add a football program. There are several things to consider.

The IRS is making some changes to their application for tax exempt status, the Form 1023-EZ. What are the changes and how will they affect homeschool groups?

A church worries that letting a classical homeschool program use their building threatens its property tax exemption.

What can you do to protect your homeschool group's leaders?

Do you know the difference between nonprofit and tax exempt status?

Terms like 501c3, association, nonprofit and tax exempt can be confusing.