What is the difference between a homeschool support group and a homeschool co-op?

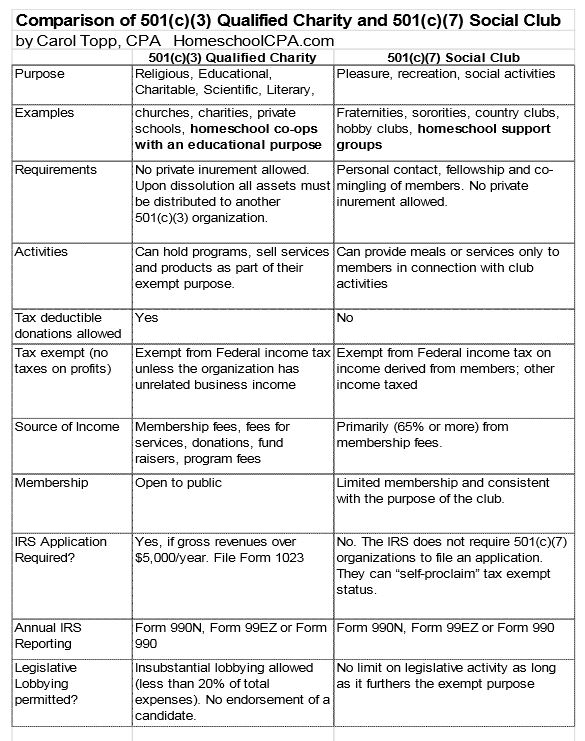

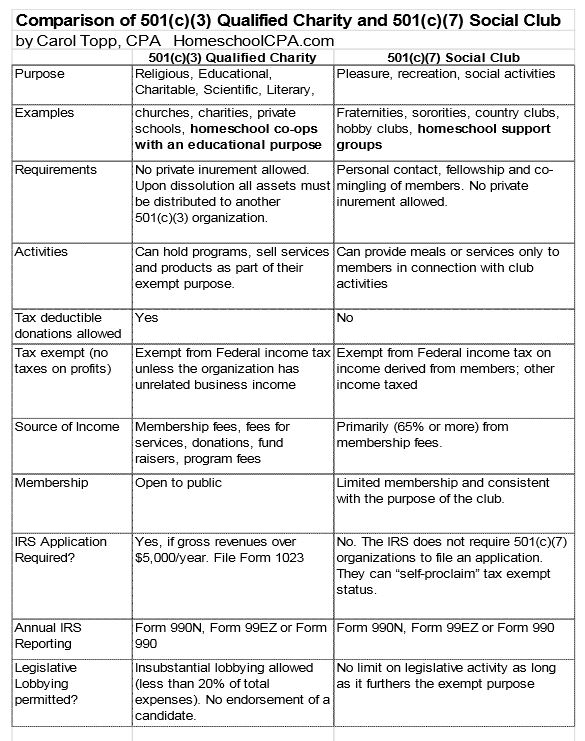

One difference between a homeschool co-op and support group is their tax exempt status in the eyes of the IRS.

One difference between a homeschool co-op and support group is their tax exempt status in the eyes of the IRS.

A homeschool leader wonders if getting a new id number from the IRS will solve his problems.

Do you know the pros and cons of 501(c) tax exempt status? Do you know what tax exempt status could mean for your homeschool group?

Does getting an EIN mean you must file a return with the IRS?

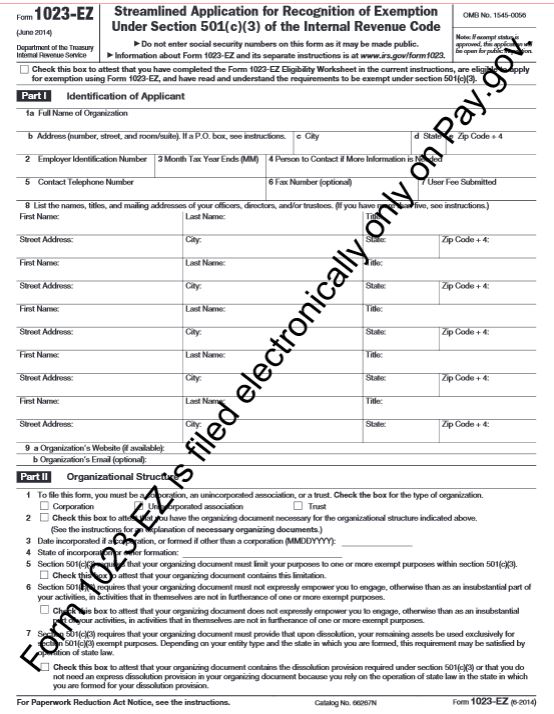

Did you know the IRS recently (July 1, 2014) released a new, shorter application for 501(c)(3) tax exempt status?

The IRS requires all nonprofit organizations to file an annual information return called a Form 990-that means your homeschool group!

Error in the IRS and Your Homeschool Organization book

Do you get a new number when your nonprofit becomes a 501c3?

List of IRS approved providers for filing prior year Form 990N

This new IRS form will make applying for tax exempt status much easier for small nonprofits.