Tax Exempt Q&A with Homeschool Leaders

Carol Topp, CPA answers questions from homeschool leaders about self-declaring tax exempt status for your homeschool support group.

Carol Topp, CPA answers questions from homeschool leaders about self-declaring tax exempt status for your homeschool support group.

A homeschool group incorrectly tells the IRS they are a private foundation.

Your homeschool support group is probably a social club in the eyes of the IRS. Social clubs can get automatic tax exempt status without applying, but they must maintain that tax-free status.

How a homeschool group can "self declare" its tax exempt status.

Carol Topp, CPA the HomeschoolCPA has a few idea to help the IRS decrease erroneous automatic revocations.

Ways to thank your volunteers that are tax-free.

A podcast episode that explains the difference and why it matters how you classify your homeschool group's workers.

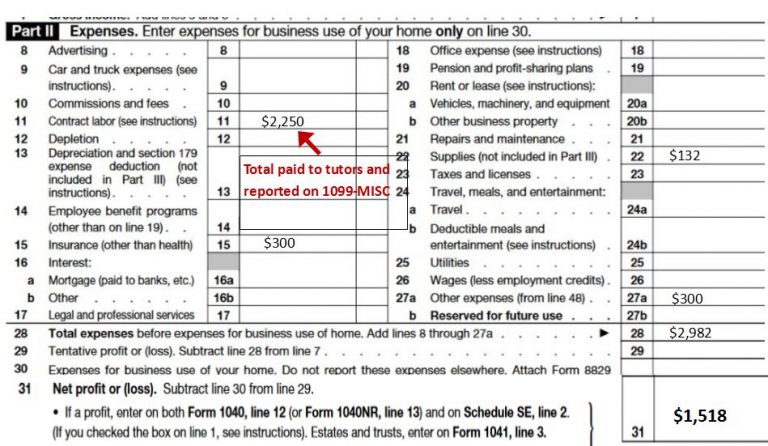

Homeschool business owners can learn how to prepare their tax returns

A new Classical Conversations Director asks how to report her income and expenses on her tax return.

Helping homeschool leaders know what to do if their organization has lost its tax exempt status.