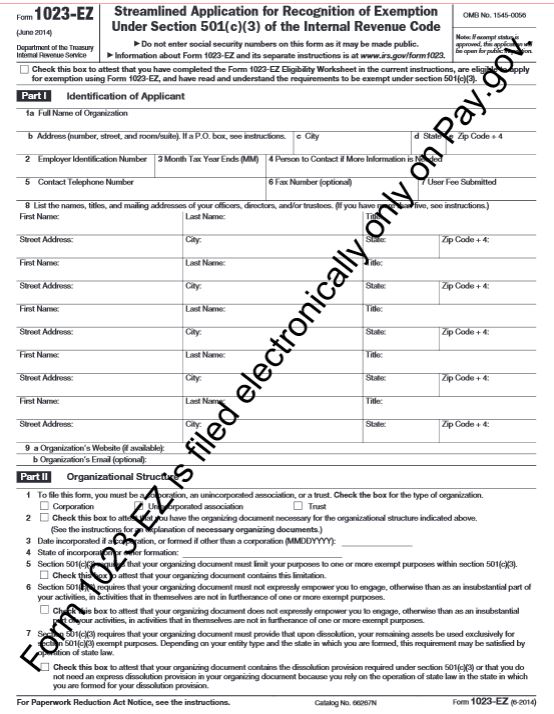

Can my CC group become a nonprofit and use the Form 1023-EZ?

I have been a director of a homeschool educational group (Classical Conversations) as an individual DBA. I have been paid but the money goes back into paying others for my kids’ education and materials for the group – generally no…