The US Department of Treasury wants all “business entities” formed by filing with their Secretary of State to register in 2024 in their new Beneficial Ownership Information Reporting. Here’s a handy information brochure.

This new new federal database is designed to identify criminals, money launderers, and other bad actors who use companies to conceal their identities and evil deeds through shell companies. So like many reporting rules, we, the honest, legitimate entities have to register and file annual reports.

Do homeschool groups have to register and file these FinCEN reports? Maybe not!

The new federal Beneficial Ownership Information Reporting requirements applies to corporations, LLCs, partnerships, or any business entity that is created once a document is filed with a Secretary of State. That could mean homeschool groups if they filed Articles of Incorporation with their Secretary of State.

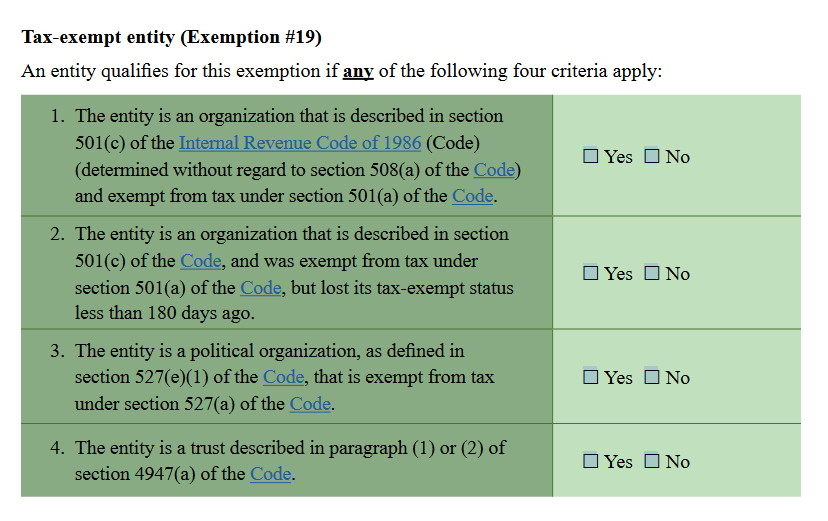

But there are exceptions! And being a 501(c)(3) is one of the exceptions.

The good news is that your homeschool group--if you have 501(c)(3) tax exempt status from the IRS– does NOT have to register and report to this new system!

If you are unsure if your organization has 501(c)(3) tax exempt status, look them up in the IRS list of Exempt Organizations: https://www.irs.gov/charit…/tax-exempt-organization-search

The Beneficial Ownership Information Small Entity Compliance Guide from the US Department of the Treasury gives us the details on qualifying for an exception from registering and reporting.

Source: https://www.fincen.gov/sites/default/files/shared/BOI_Small_Compliance_Guide_FINAL_Sept_508C.pdf, page 11 accessed January 11, 2024

It mentions Section 501(c) of the IRS Code. We’ve all heard of 501(c)(3); those organizations fall under 501(c). But it also mention 501(a) of the IRS Code. What’s that?

Section 501(a) simply says this:

(a) Exemption from taxation.

https://www.law.cornell.edu/uscode/text/26/501

An organization described in subsection (c) or (d) or section 401(a) shall be exempt from taxation under this subtitle unless such exemption is denied under section 502 or 503.

It is sort of the “header” for the rest of the Section 501. Section 501(c) goes onto list various types of nonprofits (there are 29 of them!) and includes the popular 501(c)(3). So if you have current 501(c)(3) status, you fall under 501(a) as well. 🙂

Source: https://www.law.cornell.edu/uscode/text/26/501

So if your homeschool group has current 501(c)(3) status from the IRS, you are exempt from this FinCEN reporting. Yeah!

A few more details…

Section 501(a) also mentioned Sec 502 and 503. Section 502 basically says that for profit businesses cannot be tax exempt under 501(a). That makes sense-for profit businesses pay taxes.

Section 503 says if you engage in any “prohibited transactions” you organization will lose its tax exempt status. The biggie there is diverting your income to the creator, major donors or insiders. That is called inurement. The IRS would have made a ruling against your organization and yanked its tax exempt status, so you would know if that happened!

So if your homeschool group is NOT tax exempt with the IRS, then you may have to comply with this new FinCEN reporting. It would be beneficial to apply for 501(c)(3) tax exempt status now.

My advice

Figure out what type of entity your homeschool group is: unincorporated nonprofit association, nonprofit corporation, tax exempt, a sole proprietor, or LLC. Look on your Secretary of State’s website and look through your old, founding paperwork.

Read over the Beneficial Ownership Information Compliance Guide and follow their charts to see if you are required to register or fall under an exception.

If you need help sorting this out contact one of HomeschoolCPA’s Recommended Consultants. They homeschool leaders themselves and are familiar with homeschool organizations and can help you apply for 501c3 tax exempt status too!

Carol Topp, CPA

HomeschoolCPA.com