Our homeschool group was founded a few years ago with the mission of providing support for local homeschoolers. Since then the membership and monies have grown that we needed to establish a bank account.

The bank informed me that our group needed to apply for an EIN number online through the IRS which I did. However, I found out that we need to file additional paperwork e.g. Form 1024 as a 501(c)7 nonprofit.

We are not a large group and don’t want to apply for a Nonprofit Corporation or 501(c)3 status. We just want to open an account to deposit monies from membership dues and recently held a rummage sale that all our members donated items to be sold. We don’t sell services or have paid employees. The monies go to website fees and events that our homeschool members participate in.

Tom

Tom,

From your description of your homeschool support group, it sounds as if you fit the IRS definition of a 501(c)(7) Social Club.

Here’s a blog post about what it takes to be classified as a 501(c)(7) social club

https://homeschoolcpa.com/are-homeschool-support-groups-automatically-tax-exempt/

501(c)(7) Social Clubs can “self proclaim” their tax exempt status and you do not have to file the Form 1024.

Here’s a blog post I wrote on the subject:

https://homeschoolcpa.com/can-a-homeschool-group-self-declare-501c7-social-club-status/

Be sure to maintain your tax exempt status too!

Be aware that while a 501(c)(7) Social Clubs can “self proclaim” their tax exempt status and not file the official IRS paperwork, social clubs must maintain their tax exempt status by filing the IRS Annual Information ePostcard, Form 990-N.

Since you didn’t apply for tax exempt using the IRS Form 1024, you’re not in the IRS database and cannot file the Form 990-Ns. So you need to call the IRS Customer Account Services at 1-877-829-5500 and be added to their database so you can begin filing the Form 990-Ns.

When you call the IRS, say something like this,

“We’re a 501c7 Social Club and my CPA said I needed to get added to the IRS exempt organization database, so we could start filing the 990-Ns.”

This blog post has a few more tips. How to get added to the IRS database and file the Form 990N

Learn more about getting tax exempt status

Tom’s organization wants tax exempt status as a 501(c)(7) social club, but more homeschool groups are eligible for 501(c)(3) status as educational organizations especially if they conduct classes for homeschool students.

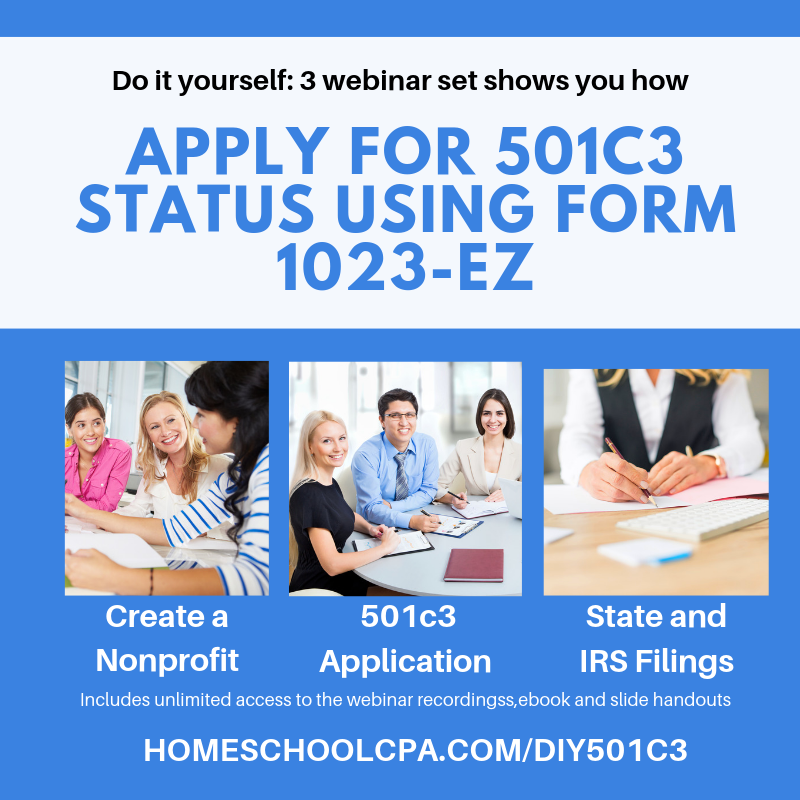

For more information on applying for 501c3 tax exempt status as an educational organization check out HomeschoolCPA’s webinars. There’s one specifically on the IRS application Form 1023-EZ.