Currently we are carrying money over into this year from last year. This money doesn’t have a name, we have it on a line that says, “Balance Carried Forward from 2015-2016” in our income column. Should this be called “Starting Balance,” or should this be named something else?In our next two budget years, we will have a surplus. We are unsure what to call this surplus money. We do have a reserve fund already set up in our budget; would this be the place to put the surplus money and then carry that reserve fund over to the income/expense section year to year?Thank you so much for all your help!!Heidi R in PA

Heidi,

You’ve hit on something very basic in accounting: how to account for accumulated money (aka a surplus).

The surplus is not income for the year so it should not be added to your other sources of income. The surplus is really an asset. It is cash sitting in your checking account.

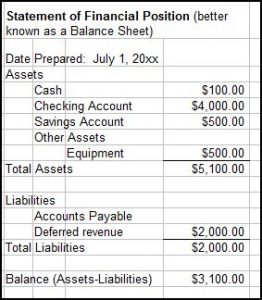

Accountants created a special financial statement called a Balance Sheet to list the assets and liabilities. For nonprofits, it’s called a Statement of Financial Position, which I like better as a name.

I recommend you create a mini balance sheet/Statement of Financial Position to the side of your income and expenses statement. Put the bank balance as of a certain date. List any liabilities (debts you owe) too. Make a note of the cash in the bank that is set aside as your reserve fund.

Your reserve fund is not an expense. It is an asset (cash in the bank). It should be mentioned in a note on the Statement of Financial Position as a reminder to your board that although the money is in the bank, it’s not supposed to be spent. It’s held in reserve for emergencies.

I give examples of financial statements including the Statement of Financial Position in Chapter 4 of Money Management in a Homeschool Organization

I hope that helps,