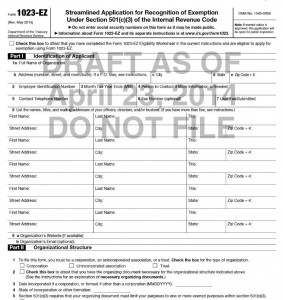

The IRS is proposing a Form 1023-EZ to make applying for tax exempt status a bit easier.

The instructions for the proposed form state that it can only be used by organizations that expect to be relatively small with no more than $200,000 in annual gross receipts and no more than $500,000 in total assets and are not churches, schools, hospitals, supporting organizations. There are other restrictions on who can use the Form 1023-EZ. See the checklist for eligibility here. Scroll down to page 33 and 34.

That describes almost all of the homeschool organizations I know.

This Form 1023-EZ could be a huge help to small homeschool organizations that need to file the Form 1023 to apply for tax exempt status or by organizations that had their tax exempt status revoked for failing to file the Form 990N for 3 consecutive years.

The Form 1023-EZ is not quite ready yet, but I’ll announce it here and on my Facebook page when it is ready. You can sign up for my email list on the sidebar to the right and will get notification that the Form 1023-EZ is ready (and a lot of other helpful information!)

Carol Topp, CPA

Is there a target date for this new form?

The IRS stated on their website that they hope to have the Form 1023EZ ready by this summer, but I never believe the IRS can get things done as fast as they say they can ! 🙂