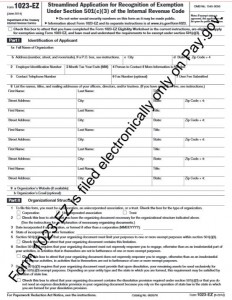

On July 1, 2014, the IRS announced it a new Form 1023-EZ to make applying for 501(c)(3) tax exempt status easier.

This shorter form makes the IRS approval process much quicker. Typically 2-4 weeks instead of 6-12 months.

Is your nonprofit organization eligible to file the shorter form?

The instructions include an eligibility checklist of 30 questions. Answering YES to any one of the question makes you ineligible to use the Form 1023-EZ. You must use the full version Form 1023.

Most charitable nonprofit organizations with annual gross receipts of $50,000 or less and assets of $250,000 or less are eligible to file the Form 1023-EZ.

Schools, churches and hospitals must still file the full version Form 1023, even if they are under the dollar thresholds.

Organizations converting from a for-profit business to a nonprofit must file the full version Form 1023, even if they are under the dollar thresholds.

If you need assistance filling in the Form 1023-EZ, contact one of HomeschoolCPA’s Recommended Consultants or this webinar will walk you though it line-by line.

This 90 minute webinar 501c3 Application for Homeschool Nonprofits will explain the pros and cons of tax exempt status, what is needed before applying for tax exempt status, the cost and steps to take, and an explanation of the IRS Form 1023-EZ line-by-line. All created for homeschool groups by CPA Carol Topp.

Hi Carol,

I took a look at the 1023-EZ worksheet to see if we qualify for filing as a tax exempt organization. Question #11 asks if we are an educational facility. Then it goes on to define what they mean. I do not know how our organization would not fall into that category. Our goal is to support homeschooling families by providing weekly classes for middle and high school students. We do make it clear that our tutors are working alongside parents. Parents have the final decision on the grade their student will receive for the class. So, what do you think? Does that mean we do not qualify to apply for tax exempt status?

Virginia,

Form 1023-EZ Eligibility Checklist Question #11 asks if your origination is a school, college or university described in section 170(b)(1)(a)(ii). That part of the Internal Revenue Code describes a school. I do not consider homeschool programs to be a school as the IRS defines “school.”

One aspect of a school is a “regular faculty,” which the IRS defines as “qualified teachers instruct the students, and the same teachers do so on a recurrent basis.” (Source: Internal Revenue Manual viewed https://www.irs.gov/irm/part7/irm_07-026-002.html#d0e549 on 5/11/15).

And by “qualified” the IRS means “certifications by the appropriate state authority or successful completion of required training.” (Source: Instructions for Form 1023)

So when you look beyond the Eligibility checklist into the guts of the IRS code, you’ll probably agree with me that homeschool organizations are not schools because they do not have regular, qualified faculty. Most of the teachers in your homeschool organization may be qualified to teach, but are not state certified, nor trained as teachers.

Your homeschool organization (probably) qualifies to be a 501(c)(3) tax exempt organization as an educational organization, but not as a school.

Carol Topp, CPA

Hello,

I am filling out the 1023-EZ form. What NTEE Code do you suggest? We are a Christian homeschool support group that offers classes one day a week. Teachers are members that volunteer to teach (we have a few paid, but they are paid directly by the parents)

Thank you for you help

Jen,

I offer specific advice on the Form 1023-EZ inputs to my nonprofit clients only. It would be irresponsible for me to answer your question until I have a client relationship with you and I have a thorough understanding of your mission, purpose, funding, status, etc. If you would like to establish a client relationship with me, I am happy to answer specific questions about the Form 1023-EZ. Please email me at https://homeschoolcpa.com/contact/

Hi Carol,

I am trying to set up a non profit for our group. My concern is that last year, because of a trip we planned, we collected close to $50,000. What happens is we are set up using the 1023 EZ form, and then we cross over to the upper limit on revenues. Does that affect our status? Do we need to worry about those what ifs? Thanks, Angela

Angela,

The IRS Instructions for Form 1023-EZ ask (in the Eligibility checklist) if your organization plans to have annual revenues of less than $50,000 per year. If you can answer yes, your organization is eligible to file the Form 1023-EZ. But if you think you’ll exceed $50,000 in annual revenues in the next 3 years, you must file the longer full Form 1023.

If you unintentionally surpass the $50,000 threshold, the IRS does not make organizations reapply for 501c3 tax exempt status.

But you will no longer be eligible to file the annual Form 990-N ePostcard information return. Instead, you will file the longer Form 990-EZ so you’ll need to have good record keeping to prepare that form.

Carol Topp, CPA